The clearing statement

The clearing statement is a PDF including the aggregated sums per account and currencies. If the payout amount is negative, the clearing statement is an invoice. The statement also shows pay-out amounts and fees. This PDF report is based on the transaction data in PPRO’s processing system.

The clearing (or invoice) statement has a structured continuous naming. The naming convention for the statement is built:

<Merchant Number>-<Frequency>-<Year>-<Ongoing Number>-<Statement Type>

Example: 1-999-W-2016-07-C0.pdf

| Parameter | Length/Format | Description |

|---|---|---|

| 1 | Single-digit | The PPRO entity. Possible values:1 - PPRO (default)106 - PPRO Mexico107 - PPRO Brazil |

| Merchant Number | Consists of 3 or 4 numbers separated by a dash | PPRO internal identifier of merchant/PSP/Referrer |

| Frequency | “D” for daily “W” for weekly, “M” for monthly | Indicates settlement frequency for the merchants/payment method type contained in a file |

| Year | 4-digit year | Year of the settlement period |

| Ongoing Number | 1-, 2-, or 3-digit number | A value of n indicates that this is the n-th settlement of this settlement period |

| Statement Type | C0/I0 | Indicates if it is a clearing (C0) or invoice (I0) |

The statement is divided into different areas:

- Summary for currency

- Intermediate summary for currency

- Details for CONTRACT (where CONTRACT is the PPRO-assigned Merchant Contract ID)

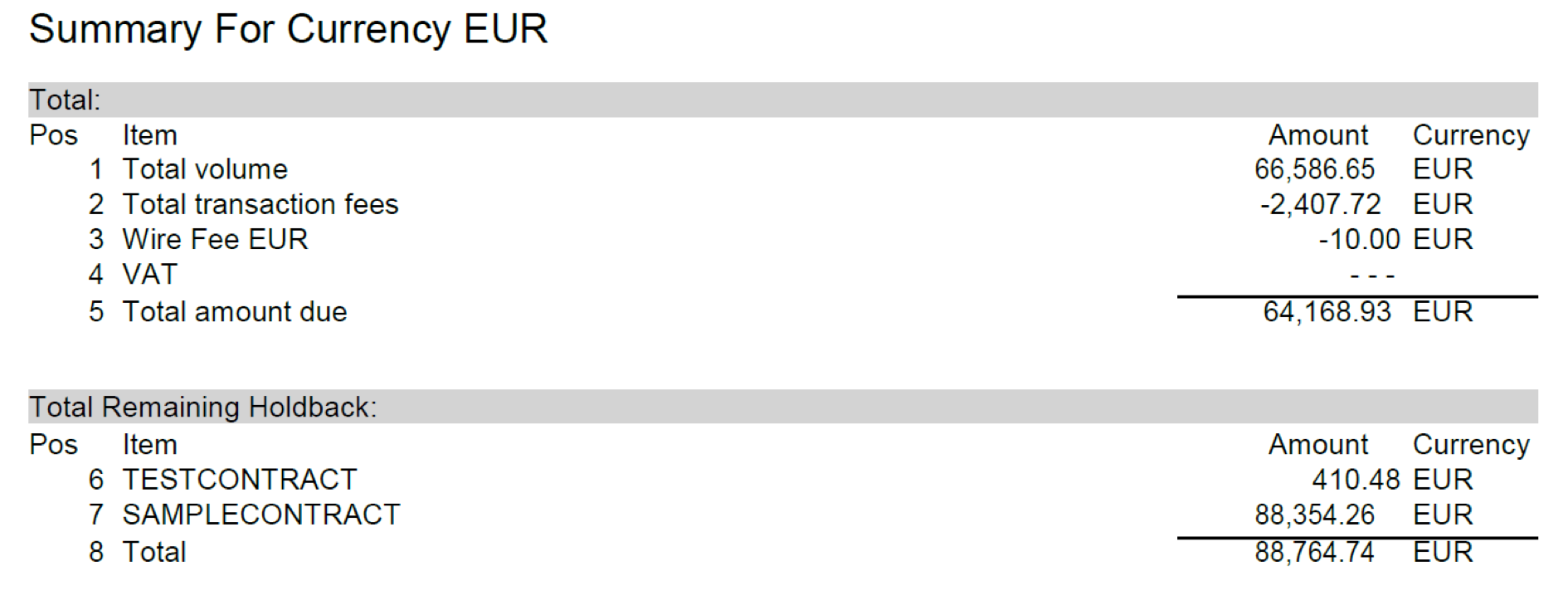

Clearing statement summary (sample) for EUR

In this case position 5 (Total amount due) shows the amount which you receive from PPRO in Euro (EUR) if positions 2 and 3 are subtracted from position 1. If a client uses payments with different currencies e.g. USD, GBP, etc. the payments would also be visible in this part of the invoice (e.g.: Summary For Currency USD).

The “Holdback” describes the amount of money that PPRO has to hold back to cover chargebacks or payouts.

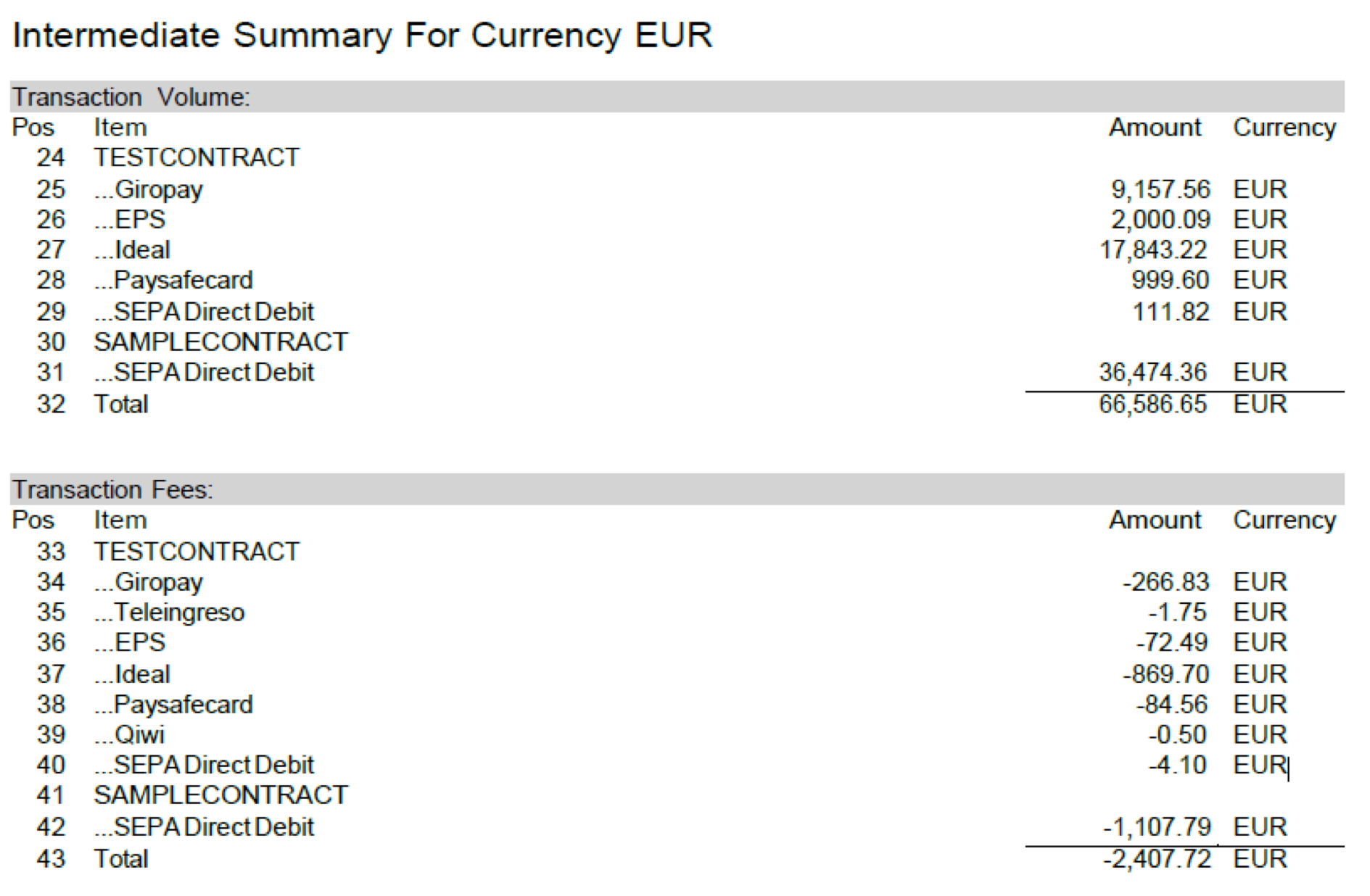

Clearing statement intermediate summary for EUR

This part of the invoice is separated into two parts: In the first part “Transaction Volume” shows the EUR amount which the client receives from PPRO listed by payment scheme per merchant contract identifier. In this example, the merchant contract identifier is TESTCONTRACT.

The second part, “Transaction Fees“, shows the fees for each payment scheme which was processed via each MerchantContract.

If multiple currencies are used, separate per-currency sections, like the EUR sample above, will be shown in this part of the document.

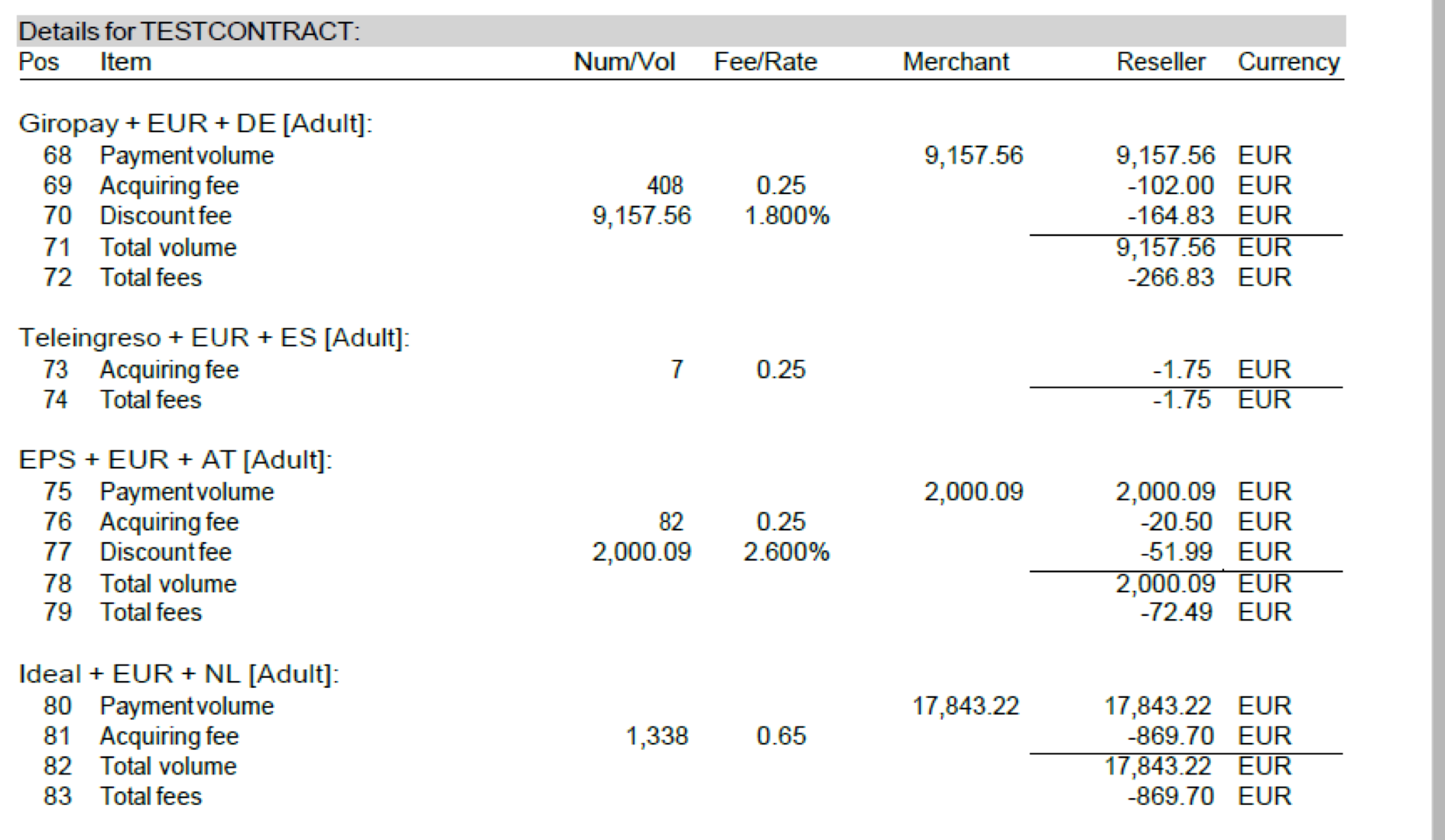

Clearing statement details for a merchant contract

This section highlights the individual fees assessed to a merchant (in this case, TESTCONTRACT).

Updated over 1 year ago