Bancontact WIP

Bancontact Wallet Initiated Payments (WIP) allows initiation by the merchant or the consumer of a card-not-present payment transaction without performing Strong Customer Authentication after previous enrollment of the Bancontact Card in a container object called a Payment Agreement

That enables the customers to offer one-click payment flows and the customers/merchants to initiate recurrent payment flows, unlocking value for use cases like e-commerce, gaming and market places, and enabling subscription models.

On Payment Agreements

A Payment Agreement is a container object facilitating a model where you can easily initiate subsequent payment charges against a consumer account, without the need for consumer interaction. This is important for scenarios such as recurring payments, or any case where merchants want to initiate payments on their own schedule.

Payment Method Properties

| Available country codes | BE |

| Processing (Presentation) currencies | EUR |

| Settlement currencies | EUR |

| Consumer currencies | EUR |

| Minimum transaction amount | EUR 0.01 |

| Maximum transaction amount: Recurring | EUR 500.00 (to be increased to €1,500 from May 1, 2025) |

| Maximum transaction amount: One-Click | EUR 500.00 |

| Session timeout | 1 hour |

| Refund | Full, partial and multiple partial are all available. |

| Sandbox | Yes, PPRO-Hosted |

Maximum Transaction amount per Merchant

Bancontact also imposes a maximum transaction amount on each Merchant after onboarding:

- The amount of a WIP Transaction must be lower than or equal to the WIP Maximum Merchant Amount

allowed to the Merchant- The WIP Maximum Merchant Amount must be lower than or equal to the global WIP Maximum

Transaction Amount- Split Payments using WIP Transactions are not allowed. The Merchant is not allowed to trigger a payment for an amount that would be larger than its WIP Maximum Merchant Amount by initiating multiple WIP transactions of an amount lower than the WIP Maximum Merchant Amount.

Bancontact Maestro co-branded cards phase out

Be aware that starting mid-2023, MasterCard is phasing out the Maestro product. Bancontact cards co-branded with Maestro will be replaced by cards co-branded with Debit MasterCard or VISA Debit, featuring new card numbers (PANs) and BINs.

Cardholders will need to re-enroll their new cards to continue using Bancontact WIP services.

Please ensure your systems are ready to support this update.

Bancontact WIP Requirements for Merchant <> Cardholder Interaction

To support Bancontact WIP, the Merchant must meet specific UX requirements on its checkout page:

- The Merchant shall have a simple and easily accessible procedure in place to allow the Cardholder to dispute a WIP Transaction or to ask the Merchant to cancel a WIP transaction through a refund.

- The Merchant shall have a simple and easily accessible procedure in place to allow the Cardholder to add, update or delete his Bancontact card(s) used to perform WIP Transactions.

- An electronic transaction receipt shall be sent to the Cardholder containing all mandatory transaction data as well as a clear procedure to ask the Merchant to refund this transaction or retain any future payments in the case of a recurring payment.

- The cardholder shall have established a relationship (As a minimum, the Cardholder shall have approved the Terms and Conditions of the WIP Merchant) with the Merchant to receive ongoing services and give permission to the WIP Merchant to debit his account on a recurring or ad-hoc basis.

Authentication Flow

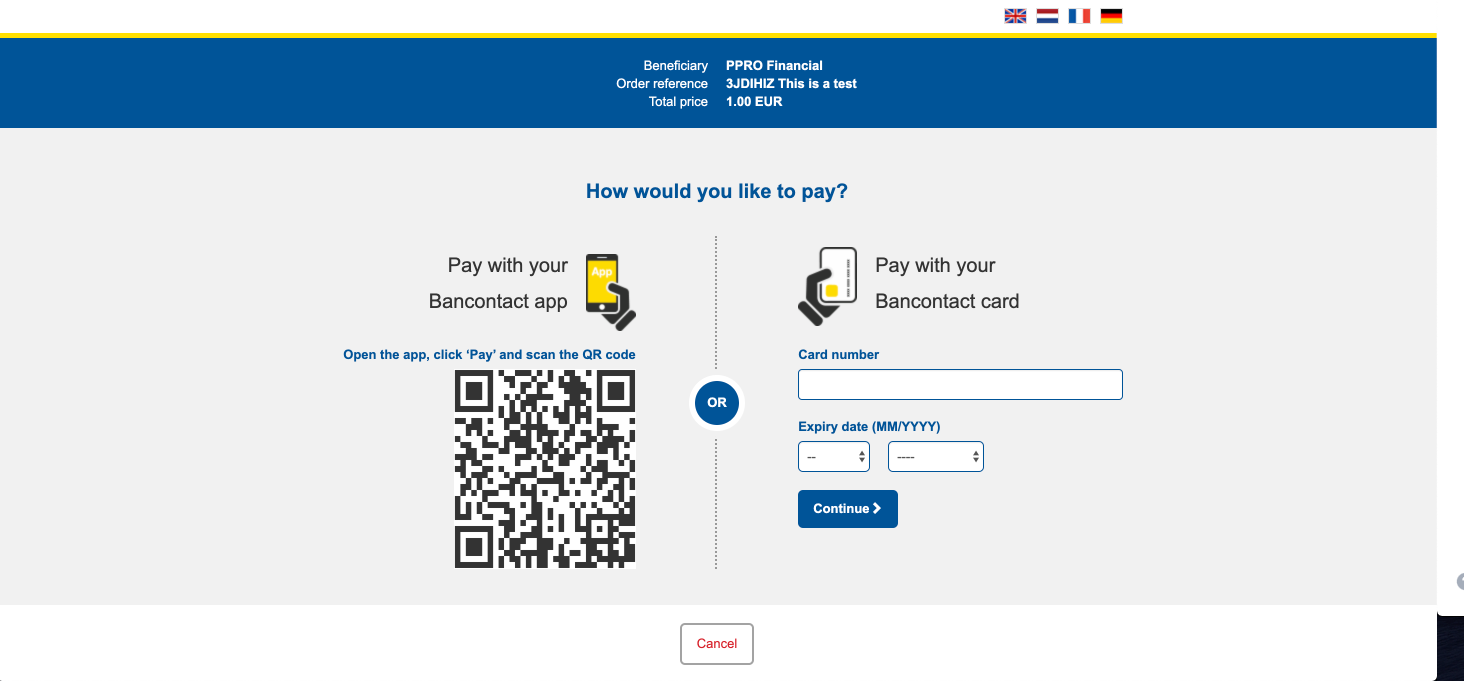

The authentication flow for Bancontact WIP first transaction attempt is very similar to Bancontact, also including a Hosted Payment Page (HPP) redirect for initial customer initiated transactions + Scan QR Code or App Intent or 3DS.

For card-non-present e-commerce flows (Bancontact WIP) the transaction doesn't need to be re-authenticated by the consumer.

Bancontact's HPP for Desktop

Disputes, Chargeback and Fraud Management

Bancontact WIP transactions have the same risk/authentication profile as 3DS authenticated transactions, so disputes are extremely uncommon, and there is a liability shift from the merchant to the issuer in these purchases.

However, onboarding reliable merchants is extremely important, as the risk of fraudulent merchants can rely on PPRO and the PSP customer.

If Dispute or Fraudulent transactions exceed exclusion rates set by the scheme, the merchant might be excluded from Bancontact WIP, reach your account manager for more information.

Link and Pay Integration Flow

Link and Pay works by registering the card payment instrument and initiating the first payment charge in a single step.

1. Create an Agreement + customer initiated transaction at TRANSACTION

During the initial consumer-initiated transaction, merchants are required to create a payment agreement. PPRO will securely store the consumer's card details as part of this agreement, and SCA will be needed. For subsequent transactions, the merchant simply needs to provide the agreement ID as input for WIP transactions.

This eliminates the need for the user to authenticate or follow the regular flow again, as the stored card information will be used to process the payment seamlessly.

In your <https://api.girogate.de>AGREEMENT POST request, include:

tag=bcmc

&txtype=AGREEMENT

&login=johndoetest

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOETESTCONTRACT

&accountholdername=John%20Doe

&channel=testchannel

&countrycode=BE

¤cy=EUR

&amount=1055

&amounttype=MAX

&startdate=2023-11-03T11:23:47.123Z

&enddate=2024-11-03T11:23:47.123Z

&frequencyinterval=1

&frequencytype=MONTHLY

&merchantredirecturl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php

&merchantagreementid=OTp4AF6yODQe

¬ificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php

&initialtransactionmerchanttxid=MYp3MF6zHDQm

&initialtransactionisocurrency=EUR

&initialtransactionamount=1000

&initialtransactionnotificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php

&specin.dynamicdescriptor=DynDescriptor

&specin.initiation=consumer

&returnmode=urlencodeext

Many of the fields should appear familiar from the standard TRANSACTION call from Simple API. Fields description:

| Field Name | M/O/C | Description |

|---|---|---|

returnmode | M | Can be set as urlencodeext or json |

txtype | M | Must always be set to AGREEMENT |

login | M | The PPRO-provided login. |

password | M | The PPRO-provided password. |

contractid | M | Defines the merchant for whom PPRO is processing the transaction. |

channel | M | The channel in the contract to use for the transaction. testchannel for testing and livechannel for production. |

tag | M | Must always be set to bcmc |

currency | M | The 3-letter ISO currency code (e.g. EUR) |

amount | M | The amount to wire in the currency’s smallest representable unit as per ISO4217. Example: For EUR 0.01, the amount is 1. For EUR 1.00, the amount is 100. |

countrycode | M | The 2-letter ISO country code from which the consumer will be paying. This also typically aligns with the locale of the payment method, as many methods are only valid in a single country. For details, see payment method-specific documentation. |

accountholdername | M | The account holder - minimum of 3 characters, up to 100 characters. UTF-8. |

merchantredirecturl | M | The URL the consumer will be redirected to after the transaction succeeded or in case of abort/failure. Minimum length of 13 characters. Maximum length of 255 characters. Must start with http:// or https://. Allowed characters are the ascii range [a-zA-Z0-9] and the following characters: -._~:/?#[]@!$&'()*+,;=% |

notificationurl | M | The URL signalled for the final status of an agreement via Notification. The same restrictions as for merchantredirecturl apply. |

amounttype | O | If value is EXACT, then subsequent transaction amounts must match the amount specified in the agreement. If MAX, any amount beneath the agreed amount is supported. Defaults to MAX. |

startdate | O | The earliest date after which the consumer agrees to be charged. Defaults to the agreement creation date. |

enddate | O | The last date you can charge the consumer under this agreement. |

frequencyinterval | O | A number describing the interval between payments. Example: if the value is 2 and frequencyType is WEEKLY, then it means the consumer agrees to be charged every 2 weeks. Defaults to 1. |

frequencytype | C | DAILY, WEEKLY, MONTHLY or YEARLY. Required if frequencyinterval is included. |

initialtransactionmerchanttxid | M | Same format as merchanttxid in a TRANSACTION request. |

initialtransactionamount | M | Same format as amount in a TRANSACTION request. |

initialtransactionisocurrency | M | Same format as currency in a TRANSACTION request. |

initialtransactionnotificationurl | M | The URL signalled for the final status of a transaction via Notification. The same restrictions as for merchantredirecturl apply. |

specin.initiation | M | Set as consumer. |

specin.dynamicdescriptor | O | Defines the text on the consumer’s proof of payment (e.g. bank statement record and similar). Typical use cases for this feature: providing (sub-)shop name, a thank you message, product description, etc. |

AGREEMENTID=agr_2sd3jkds3lsdk32lsd8ak

&STATUS=PENDING

&INITIALTRANSACTIONID=140011837448

&MERCHANTAGREEMENTID=OTp4AF6yODQe

&ERRMSG=

&CHANNEL=testchannel

&TAG=bcmc

&REDIRECTURL=https%3A%2F%2Fbancontact%2Dppro%2Ecom%2FT%2FI%3Ftx%3D140011837448%26rs%3D4eukBgRfmvKOSMU3BOmuvGk4bpbwg3Vb%26cs%3Dc7dbb38be368a0589bc0eecca68b859ad75af6906aa59b8cc09c685ecd4d29ff

&REDIRECTSECRET=fA7QdJvIIZBiWicglpI32MMT1aAchhR8

| Field Name | Description |

|---|---|

AGREEMENTID | The id of the persisted agreement. Example: agr_2sd3jkds3lsdk32lsd8ak. You will need to store this value so you can pass it in future TRANSACTION calls once the AGREEMENTSTATUS is ACTIVE. |

STATUS | Enum with possible values: PENDING, ACTIVE, FAILED, REVOKED_BY_CONSUMER, REVOKED_BY_MERCHANT. For this specific response the status PENDING or FAILED are possible. |

Link between Agreement Creation and Transaction Success

Agreements are created only for successful transactions.

If a transaction returns as FAILED the agreement will not be created and return the status FAILED.

2. Wait for Status Change Notification

After initiating an agreement creation and transaction, wait for a notification indicating a status change for the transaction and the agreement.

PPRO sends notifications whenever the state of a transaction changes to either SUCCEEDED or FAILED. These notifications are transmitted to a script running on your web server using an HTTP(S) POST request. PPRO expects a response which verifies that you received the complete notification without errors. In case of a transmission failure, PPRO retransmits the notifications in defined intervals for a determined maximum number of retries.

After a successful receipt, call GETTXSTATUS to get the transaction status.

Transaction Notifications

txid=140011837448

&finaltimestamp=2025-11-03T11%3A23%3A47-00%3A00

&sha256hash=dfbcdd35ff5c418e7bd8cbd736cb2708592825fab74a46d1c6baac3884a98686

PPRO will send 2 transaction status change notifications

Bancontact transactions follow a two-step process in which PPRO first performs an authorization, followed by a capture of the transaction with Bancontact.

This process runs seamlessly in the background, but you will receive two separate webhook notifications—one for each step. In both cases, the transaction status retrieved via the GETTXSTATUS call will be SUCCEEDED.

Agreement Notifications

agreementid=agr_2sd3jkds3lsdk32lsd8ak

&finaltimestamp=2025-11-03T11%3A23%3A47-00%3A00

&sha256hash=dfbcdd35ff5c418e7bd8cbd736cb2708592825fab74a46d1c6baac3884a98686

| Field Name | Description |

|---|---|

agreementid | The agreementid value returned in the AGREEMENT call. |

More about this flow at Simple API's Notifications.

3.1. Retrieve Agreement Status at GETAGREEMENTSTATUS

In your <https://api.girogate.de>GETAGREEMENTSTATUS POST request, include:

txtype=GETAGREEMENTSTATUS

&login=johndoetest

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOETESTCONTRACT

&agreementid=agr_2sd3jkds3lsdk32lsd8ak

&returnmode=urlencodeext

AGREEMENTID=agr_2sd3jkds3lsdk32lsd8ak

&REQUESTSTATUS=SUCCEEDED

&STATUS=ACTIVE

&MERCHANTAGREEMENTID=OTp4AF6yODQe

&ERRMSG=

&INITIALTRANSACTIONID=140011837448

&CHANNEL=testchannel

&TAG=bcmc

&REDIRECTURL=https%3A%2F%2Fbancontact%2Dppro%2Ecom%2FT%2FI%3Ftx%3D140011837448%26rs%3D4eukBgRfmvKOSMU3BOmuvGk4bpbwg3Vb%26cs%3Dc7dbb38be368a0589bc0eecca68b859ad75af6906aa59b8cc09c685ecd4d29ff

&REDIRECTSECRET=fA7QdJvIIZBiWicglpI32MMT1aAchhR8

3.2. Retrieve Transactional Status at GETTXSTATUS

In your <https://api.girogate.de>GETTXSTATUS POST request, include:

txtype=GETTXSTATUS

&login=johndoetest

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOETESTCONTRACT

&txid=140011837449

&returnmode=urlencodeext

| Field Name | M/O/C | Description |

|---|---|---|

returnmode | M | Can be set as urlencodeext or json |

txtype | M | Must always be set to GETTXSTATUS |

login | M | The PPRO-provided login. |

password | M | The PPRO-provided password. |

contractid | M | Defines the merchant for whom PPRO is processing the transaction. |

txid | M | The id of the transaction for which you are requesting the status |

{

"CHANNEL": "testchannel",

"ERRMSG": "",

"FLAGS": "",

"FUNDSSTATUS": "RECEIVED",

"MERCHANTTXID": "1747662590",

"RAND2152402670": "449249d9703062f7651f1e29a6ec0f14da3f5a95",

"REDIRECTSECRET": "",

"REDIRECTURL": "https://authman.qa.lp-pl.ppro.com/v0/pages/?redirection_token=eyJhbGciOiJIUzUxMiJ9",

"REQUESTSTATUS": "SUCCEEDED",

"SPECOUT.BEPURL": "BEP://1BANCONTACT.CARD-INTEGRATIONS.NON-PROD.PPRO.COM/BEP/LA/1D/1X7HMYO30XM5FLI4HF0X7IP1A443CJ8S0$JBPQLFOEK3QVURPTNNOT7I3E",

"SPECOUT.CARDBIN": "60600599",

"SPECOUT.CARDEXPIRY": "3107",

"SPECOUT.CARDLAST4DIGITS": "9023",

"SPECOUT.CARDMASKEDPAN": "60600599XXXXXX9023",

"SPECOUT.EXPIRYMONTH": "7",

"SPECOUT.EXPIRYYEAR": "2031",

"SPECOUT.PAYMENTPURPOSE": "1747662590 Dynamic Descriptor nValue",

"SPECOUT.PREFERREDLANGUAGE": "fr",

"SPECOUT.SRCBIC": "BBRUBEBBXXX",

"SPECOUT.SRCCOUNTRY": "BE",

"SPECOUT.SRCIBAN": "BE68539007547034",

"SPECOUT.TRANSACTIONFLOW": "ecommerce",

"SPECOUT.URLINTENT": "bepgenapp://DoTx?TransId=1BANCONTACT.CARD-INTEGRATIONS.NON-PROD.PPRO.COM/BEP/LA/1D/1X7HMYO30XM5FLI4HF0X7IP1A443CJ8S0$JBPQLFOEK3QVURPTNNOT7I3E",

"STATUS": "SUCCEEDED",

"TAG": "bcmc",

"TXID": "140011837449"

}

Card data in the GETTXSTATUS response

The card information (CARDBIN, CARDLAST4DIGITS, CARDMASKEDPAN, EXPIRYMONTH and EXPIRYYEAR) will be available in the GETTXSTATUS only if the STATUS is SUCCEEDED.

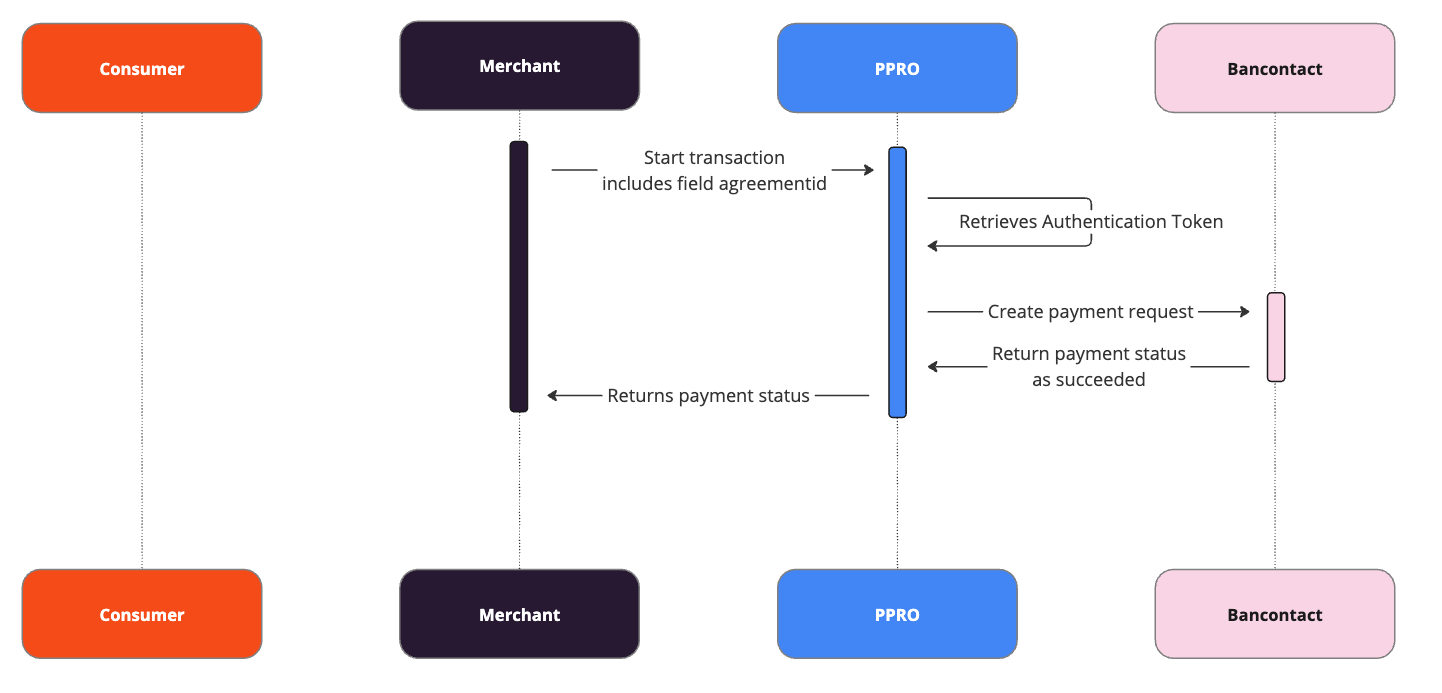

4. Create subsequent transactions at TRANSACTION

Once you confirm an agreement is active, you can pass the AGREEMENTID value when you make a TRANSACTION request.

The request structure is the same as a TRANSACTION call input for the payment method in question, plus this added AGREEMENTID field and by using SPECIN.INITIATION=MERCHANT when initializing the transaction.

In the TRANSACTION call output, you should see that the recurring payment succeeds immediately without the need to redirect / authenticate the consumer.

Differentiate one-click payments from recurrent merchant initiated payments with the field specin.initiation as describe below.

WIP transactions confirmation

WIP transactions succeed or fail synchronously. There is no redirect and no consumer interaction. In the healthy case, the status is immediately SUCCEEDED (unlike PENDING > SUCCEEDED status changes).

In your <https://api.girogate.de>TRANSACTION POST request, include:

tag=bcmc

&txtype=TRANSACTION

&countrycode=BE

¤cy=EUR

&amount=1055

&agreementid=10000

&merchanttxid=MYp3MF6zHDQm

&login=johndoe

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOETESTCONTRACT

&channel=testchannel

&merchantredirecturl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php

¬ificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php

&specin.dynamicdescriptor=DynDescriptor

&accountholdername=Tester+Doe

&preferredlanguage=fr

&returnmode=urlencodeext

&specin.initiation=merchant

| Field Name | M/O/C | Description |

|---|---|---|

returnmode | M | Can be set as urlencodeext or json |

txtype | M | Must always be set to TRANSACTION |

agreementid | M | The agreementid value returned in the AGREEMENT call |

login | M | The PPRO-provided login. |

password | M | The PPRO-provided password. |

contractid | M | Defines the merchant for whom PPRO is processing the transaction. |

channel | M | The channel in the contract to use for the transaction. testchannel for testing and livechannel for production. |

tag | M | Must always be set to bcmc |

currency | M | The 3-letter ISO currency code (e.g. EUR) |

amount | M | The amount to wire in the currency’s smallest representable unit as per ISO4217. Example: For EUR 0.01, the amount is 1. For EUR 1.00, the amount is 100. |

countrycode | M | The 2-letter ISO country code from which the consumer will be paying. This also typically aligns with the locale of the payment method, as many methods are only valid in a single country. For details, see payment method-specific documentation. |

accountholdername | M | The account holder - minimum of 3 characters, up to 100 characters. UTF-8. |

merchantredirecturl | M | The URL the consumer will be redirected to after the transaction succeeded or in case of abort/failure. Minimum length of 13 characters. Maximum length of 255 characters. Must start with http:// or https://. Allowed characters are the ascii range [a-zA-Z0-9] and the following characters: -._~:/?#[]@!$&'()*+,;=% |

notificationurl | M | The URL signalled for the final status of a transaction. The same restrictions as for merchantredirecturl apply. |

merchanttxid | O | Your transaction identifier. Allowed characters: [a-zA-Z0-9.,-_]. Maximum of 40 characters. Uniqueness is not enforced and is your responsibility in the context of a contract. |

preferredlanguage | O | The 2-letter language code (e.g. de) of the language preferred when presenting payment pages to the consumer. |

specin.initiation | M | The party initiating the transaction: - consumer - one-click payment- merchant - recurring payment |

REQUESTSTATUS=SUCCEEDED

&STATUS=SUCCEEDED

&TXID=140011837449

&ERRMSG=

&CHANNEL=testchannel

&TAG=bcmc

&REDIRECTSECRET=d6rSVahlxK0t0Du8tpD12VRE3PosHBUA

&SPECOUT.BEPURL=BEP%3A%2F%2F1BANCONTACT%2EPPRO%2ECOM%2FBEP%2F140011837448

&SPECOUT.CARDBIN=670999

&SPECOUT.CARDLAST4DIGITS=9999

&SPECOUT.CARDTOKEN=S-621f64eb-6271c974-abcd-abcd-abcd-492f7b123456

&SPECOUT.PAYMENTPURPOSE=2G2ABCD

&SPECOUT.SRCBIC=GKCCBEBB

&SPECOUT.SRCCOUNTRY=BE

&SPECOUT.SRCIBAN=BE12561483123456

&SPECOUT.CARDEXPIRY=2604

&SPECOUT.CARDMASKEDPAN=60799XXXXXX9999

Agreement and Cards Lifecycle Management

Agreement/Token Expiration

Agreements will work until the card expiry date + 14 months. Make sure you stop displaying the card link on the consumer’s payment options/applications before that time, and request the consumer to re-link a payment card - note that re-linking a card is a new payment flow; it is not possible to update an existing link.

Cards Expiration

The agreement is tied to the Card Number when it's first created. Since Bancontact debit cards expire, the scheme recommends that the issuers don’t verify the expiry date for WIP transactions. Those transactions should continue working if the card number remains the same on card renewal.

The customer is responsible for asking consumers to update the card details before expiry, and to re-link the renewed card if necessary. For this reason, we output SPECOUT.CARDBIN and SPECOUT.CARDLAST4DIGITS which can be displayed as e.g. 123456XXXXXX7890 in a confirmation dialog.

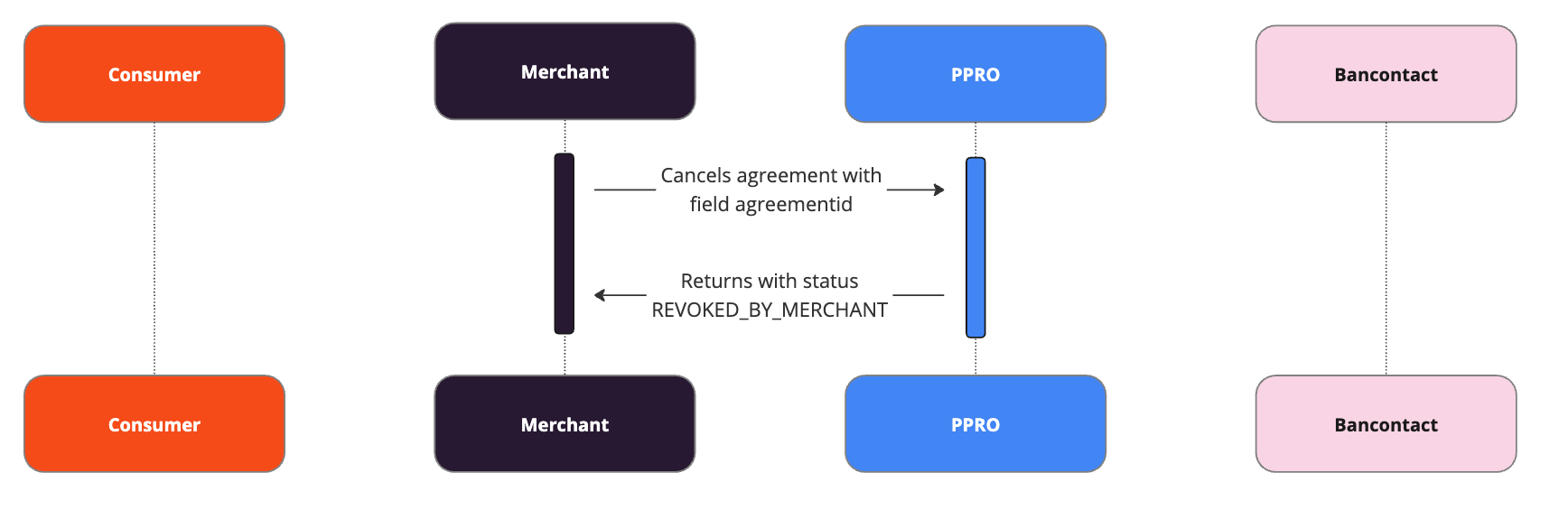

Cancel an Agreement at CANCELAGREEMENT

In your <https://api.girogate.de>CANCELAGREEMENT POST request, include:

txtype=CANCELAGREEMENT

&login=johndoetest

&password=password

&contractid=JOHNDOETESTCONTRACT

&agreementid=agr_2sd3jkds3lsdk32lsd8ak

&returnmode=json

| Field Name | M/O/C | Description |

|---|---|---|

returnmode | M | Can be set as urlencodeext or json. |

txtype | M | Must always be set to CANCELAGREEMENT |

login | M | The PPRO-provided login. |

password | M | The PPRO-provided password. |

contractid | M | Defines the merchant for whom PPRO is processing the transaction. |

agreementid | M | The agreementid value returned in the AGREEMENT call. |

REQUESTSTATUS=SUCCEEDED

&STATUS=REVOKED_BY_MERCHANT

&AGREEMENTID=agr_2sd3jkds3lsdk32lsd8ak

&ERRMSG=

&CHANNEL=testchannel

&TAG=bcmc

&REDIRECTSECRET=P7QEgfywdtrB7pgwdVEVzu4gqrHOXA1m

Retrieve All transactions for a specific Agreement

In your <https://api.girogate.de>GETAGREEMENTTXSTATUS POST request, include:

txtype=GETAGREEMENTTXSTATUS

&login=johndoetest

&password=password

&contractid=JOHNDOETESTCONTRACT

&agreementid=agr_2sd3jkds3lsdk32lsd8ak

&page=

&returnmode=json

| Field Name | M/O/C | Description |

|---|---|---|

returnmode | M | Can be set as urlencodeext or json |

txtype | M | Must always be set to GETAGREEMENTSTATUS |

login | M | The PPRO-provided login. |

password | M | The PPRO-provided password. |

contractid | M | Defines the merchant for whom PPRO is processing the transaction. |

agreementid | M | The agreementid value returned in the AGREEMENT call |

page | O | The NEXTPAGE token returned from previous calls to this endpoint, if the transaction list was paginated. |

TRANSACTIONS[0].TXID=140011837449

&TRANSACTIONS[0].STATUS=SUCCEEDED

&TRANSACTIONS[0].TXID=140011837449

&TRANSACTIONS[0].FAILREASON=

&TRANSACTIONS[0].MERCHANTTXID=MYp3MF6zHDQm

&TRANSACTIONS[0].ERRMSG=

&TRANSACTIONS[0].CHANNEL=testchannel

&TRANSACTIONS[0].TAG=bcmc

&TRANSACTIONS[0].REDIRECTURL=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php

&NEXTPAGE=sSD22i3jfDS2fjkjsJ

TRANSACTIONS=[

{

"TXID":150000635350,

"STATUS":"SUCCEEDED",

"FAILREASON":"INVALID",

"MERCHANTTXID":"53498e0a-50be-4bad-bf99-6a071073b218",

"FUNDSSTATUS":"WAITING",

"ERRMSG":"",

"CHANNEL":"testchannel",

"TAG":"mock",

"REDIRECTURL":"https://vo3z67veza.execute-api.eu-central-1.amazonaws.com/default/authenticator.html?payment-charge-id=charge_h8bXXb606YAMJHLM22Dyw"

},

{

...

}

]

NEXTPAGE=sSD22i3jfDS2fjkjsJ

| Field Name | Description |

|---|---|

TRANSACTIONS | A list of TRANSACTIONs made under the agreement. |

NEXTPAGE | A token that can be passed as a page in subsequent calls to this endpoint to get the next page of transactions if the list is too long for one response. |

Updated 1 day ago