Sofort - Now Part of Klarna

Owned by Klarna since 2014, the bank-transfer scheme Sofort has now been integrated into the Pay Now products within Klarna Payments. Using the consolidated product offering, featuring the bank-transfer functions of Sofort, customers benefit from a unified and seamless checkout experience.

Please refer toKlarna or Klarna Debit Risk for further details.

This content and page will be sunset from January 1st 2025.

Payment Method Properties

Available country codes | AT, BE, CH, DE, ES, NL |

Processing (Presentation) currencies | EUR, CHF |

Settlement currencies | EUR, CHF |

Consumer currencies | EUR, CHF |

Channel member tag | directpay |

Scheme name in the settlement file | Directpay |

Minimum transaction amount | EUR 1 (or equivalent) |

Maximum transaction amount | Low&medium risk: EUR 5,000 High risk: EUR 2,500 A VIP project can be enabled on request. The limits for VIP project are: 5,000,00 EUR / 24h 10,000,00 EUR / 24h 15,000,00 EUR / 36h 25,000,00 EUR / 24h There is an exception if an end consumer's bank has set a lower payment limit for the end consumer’s bank account than the above determined limit(s) for SOFORT. If this is the case, a SOFORT transaction exceeding this bank account limit is not possible. |

Session timeout | 1 hour |

Refund | Full, partial and multiple partial refunds are all available. |

Refund Validity | 365 days |

Chargeback | No |

Integration Type | Asynchronous |

Sandbox | Scheme-hosted |

NoteFor this country code, only EUR is supported for processing and settlement.

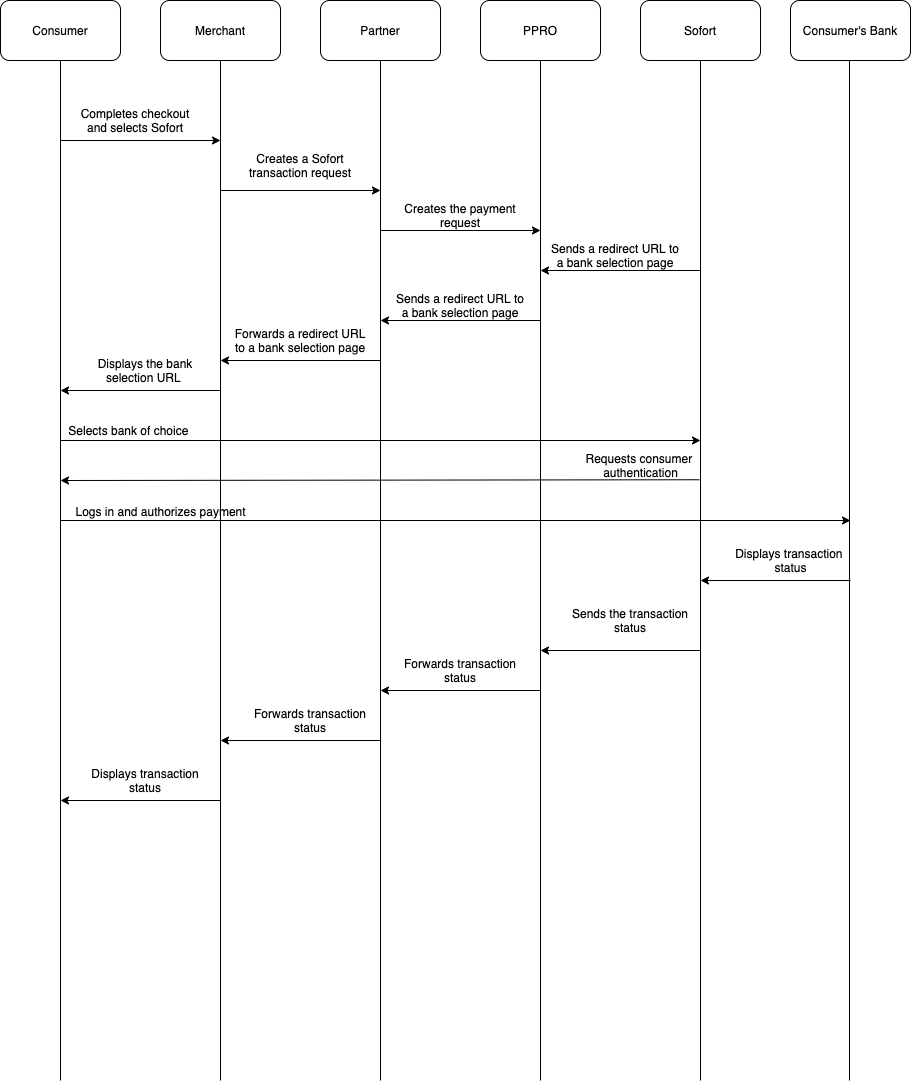

Transaction Flow

- The consumer selects Sofort as their preferred payment method.

- They are redirected to a payment page where they are presented with a list of supported banks.

- The consumer selects a bank from the list and authenticates using their login credentials and TAN in order to confirm the payment.

- The merchant receives the payment confirmation.

- The merchant can ship the order/deliver the goods to the consumer.

Sofort Integration

Specific input parameters for the TRANSACTION call

There are no specific input parameters for the TRANSACTION call.

For standard input parameters, see Input parameters for the TRANSACTION call.

Specific output parameters for the TRANSACTION call

| Field Name | Type | Description |

|---|---|---|

SPECOUT.PAYMENTPURPOSE | ascii | Reflects what a consumer sees on the proof of payment |

SPECOUT.SRCBANKNAME | ascii | The bank name of the consumer’s account |

SPECOUT.SRCACCOUNTHOLDER | ascii | The name of the account holder |

SPECOUT.SRCACCOUNTNUMBER | ascii | Consumer’s account number |

SPECOUT.SRCBANKCODE | ascii | Bank code of the consumer’s account |

SPECOUT.SRCIBAN | ascii | IBAN of the consumer’s account |

SPECOUT.SRCBIC | ascii | BIC of the consumer’s account |

SPECOUT.SRCCOUNTRY | ascii | The 2-letter ISO code of the country from where the consumer makes the payment. This parameter is only returned if allowCountryCodeSelection is enabled. |

For standard output parameters, see Output parameters for the TRANSACTION call.

TRANSACTION call input

tag=directpay

&txtype=TRANSACTION

&countrycode=DE

¤cy=EUR

&amount=1055

&merchanttxid=CeBBt4sATxs9

&login=johndoe

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOE

&channel=testchannel

&preferredlanguage=en

&merchantredirecturl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php

¬ificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php

&specin.dynamicdescriptor=DynDescriptor

&accountholdername=Tester%20Doe

&returnmode=urlencodeextTRANSACTION call output

REQUESTSTATUS=SUCCEEDED

&STATUS=SUCCEEDED

&TXID=600684703

&ERRMSG=

&CHANNEL=testchannel

&TAG=directpay

&PAYMENTGUARANTEE=NONE

&REDIRECTSECRET=wB7uCB6OTiVukEWCbNAhQDkFdEvVEEFr

&SPECOUT.PAYMENTPURPOSE=3QLHMAI DynDescriptor

&SPECOUT.SRCACCOUNTHOLDER=Max Mustermann

&SPECOUT.SRCACCOUNTNUMBER=23456789

&SPECOUT.SRCBANKCODE=88888888

&SPECOUT.SRCBANKNAME=Demo Bank

&SPECOUT.SRCBIC=SFRTDE20XXX

&SPECOUT.SRCCOUNTRY=DE

&SPECOUT.SRCIBAN=DE06000000000023456789Additional Information

Transactions may change from any state, especially from FAILED to a SUCCEEDED state at any time. SUCCEEDED itself is considered a stable state.

Branding Guidelines

For information regarding branding, see the Sofort official website.

FAQ

How is Sofort different from Klarna Pay now?

Sofort and Klarna Pay now are two different integrations. Sofort is a non-guaranteed payment method. Klarna Pay now offers a payment guarantee, which covers all industries except for:

- Financial Services (trading, money remittance)

- Gambling

- Lottery

- Other high-risk digital

For the above industries, merchants must use Sofort.

Sofort and Klarna Pay now use the same redirect Sofort URL. However, Sofort redirects to a different page for consumer banking details.

Sofort and Klarna Pay now must be represented using the same branding elements on the merchant payment page. For more information about payment badges and descriptors, see this page.

Are you integrating Klarna? Find the documentation here.

What languages does Sofort support?

Sofort supports the local language(s) of a market in addition to English. For example, Sofort in Italy supports Italian, German for the German-speaking population in the North of the country, and English. However, Sofort supports only German and English in Germany; Italian is not supported in Germany.

Why do some consumers get an ambiguous error when selecting their bank?

Sofort works externally from the banks within its network. Technical changes on the bank's side can cause a temporary disruption with Sofort's ability to scrape the login process with the bank. These disruptions are usually short.

Updated 11 days ago