Bancomat Pay Chargebacks

Notifications

PPRO sends out chargebacks/dispute requests to partners via email, and partners need to inform the merchants and respond within 15 calendar days.

Time frame

The individual phases and the relevant timings of the dispute management procedure are indicated below.

- On the initiative of the Issuer, the individual procedure is launched, based on a request from the cardholder, that meets the following requirements:

- the complaint is submitted within a maximum term of 60 consecutive calendar days from purchase

- the cardholder has produced the documentation described previously, also taking account of the dispute type

To open the dispute, the Issuer is required to fill in the dedicated screen in the portal, attach the reference documentation and make sure it is complete. This must be carried out within 90 calendar days of the purchase.

The Acquirer is required to accept the dispute and process it within 15 calendar days as follows:

- If the documentation shows that the dispute has not been opened in a timely fashion according to the terms outlined in the previous point, it closes it in favour of the Merchant using the appropriate functionality on the portal and expressly indicating the said clause

- If the documentation is incomplete, it asks the Issuer to supplement the documents, within an additional 15 consecutive calendar days, under penalty of express forfeiture, with the subsequent settlement of the dispute by the Acquirer in favour of the Merchant, using the appropriate functionality in the portal and indicating said clause

- If the documentation is complete, it immediately informs the Merchant of the dispute, with the request to the latter to produce, within a maximum term of an additional 15 consecutive calendar days, the documentation containing the supporting reasons for the case according to the elements indicated previously and notifying it that, in the case of non-acknowledgement, the dispute will nonetheless be settled in favour of the cardholder, with the subsequent obligation of reimbursement of the relevant sums. Once all documentation has been obtained from the Merchant proving its correct actions, the Acquirer will arrange for the relevant transmission through the portal, with the simultaneous closure of the dispute in favour of the Merchant; in the opposite case, it closes the dispute in favour of the cardholder through the portal, with the subsequent obligation of reimbursement of the relevant sums.

With reference to the procedure, in the event of a conflict between the Issuer and the Acquirer regarding the settlement of the individual dispute, the former can ask BANCOMAT SpA to resolve the dispute with a definitive non-contestable opinion, which the partners involved, recognize as irrevocable with the obligation to comply with the contents of said opinion. Aside from the settlement of the procedure and the opinion of BANCOMAT SpA that settles the dispute with respect to its partner, the relations between the cardholder and the Merchant remain separate and unprejudiced and they remain protected under law.

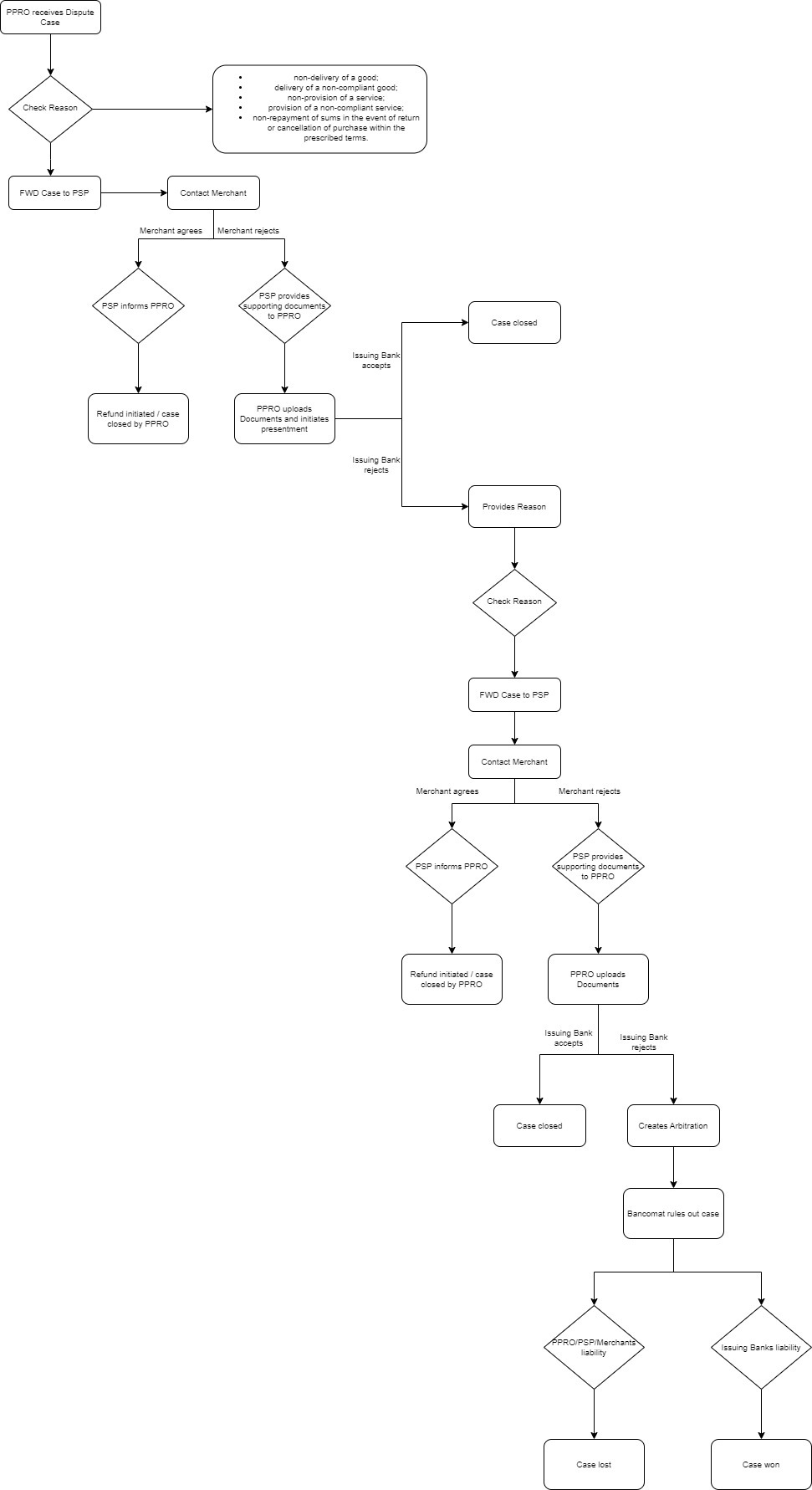

Dispute process

Before a chargeback is initiated, there is a dispute process:

- The consumer files a dispute through the issuer bank

- The issuer bank submits the dispute via Bancomat Online Portal and PPRO receives the dispute request as acquirer

- PPRO manages the dispute process via Bancomat Online Portal

- PPRO informs partners about the dispute via email and partners further communicate with merchants about the dispute

- The merchant accepts or rejects the dispute

- The issuer bank decides on the dispute case

In case the merchant loses the dispute cases (e.g. merchant does not respond), it results in a chargeback. PPRO reports the chargebacks to partners.

Chargeback Reasons

Failed/Incomplete/Late Delivery of a Good

The case in question materialises when cardholders declare that they:

✔ Have not received the goods

✔ Have not received some of the goods in the shopping cart subject to purchase (case of a single shopping cart)

✔ Have not received the good or goods in the required times and have cancelled the purchase within the prescribed terms

The Merchant, for its part, must demonstrate, in relation to the circumstances, that:

✔ The good subject to Dispute has been delivered

✔ All goods purchased in a single purchase have been delivered

✔ The goods subject to Dispute have been delivered in the required times or the sums have been refunded in the event of timely cancellation of the purchase

The documentation to be provided is listed below:

Cardholder side

- Document proving the e-commerce purchase (e.g. payment confirmation screen with a description of the good purchased) through a BANCOMAT SpA branded payment and the Merchant references.

- Correspondence/messages exchanged with the Merchant for the dispute regarding failed/incomplete/late delivery (e.g. e-mail, registered letter, screenshot of conversations in the Merchant environment) and cancellation of the purchase with request for reimbursement of sums.

Merchant side

- Justification of reimbursement of the payment (for example, in the event of an unavailable good or acceptance of the Cardholder’s request). Alternatively, proof of the correct action through:

o Carrier delivery note, in the event of a contractual clause that assigns transport risk to the purchaser and with evidence of the contractual conditions in force at the time of the purchase.

o Customer delivery receipt if the contractual conditions in force at the time of the purchase provide for a sale with transport risk borne by the Merchant.

Delivery of a Non-Compliant Good

The case in question materializes when cardholders declare that:

✔ The good received is different from the one purchased

✔ The good received has significant non-conformities (e.g. color, dimensions)

The Merchant, for its part, must demonstrate that the disputed good corresponds to the good purchased by the cardholder.

The documentation to be provided is listed below:

Cardholder side

- Document proving the e-commerce purchase (e.g. payment confirmation screen with a description of the good purchased) through a BANCOMAT S.p.A. branded payment and the Merchant references.

- Correspondence/messages exchanged with the Merchant for the disputed receipt of a good that is different from the one purchased (e.g. e-mail, registered letter, screenshot of conversations in the Merchant environment) and request for reimbursement of sums.

- Receipt note for the good in question or photo of the good received if the non-conformity concerns the external characteristics (e.g. colour, dimension); where present, copy of the documentation accompanying the good, with a description of its characteristics.

- Return note for the non-compliant good.

Merchant side

- Proof of refund in the event the cardholder's complaint is accepted. Alternatively, proof of the correct action based on one of the following assumptions:

- evidence of the untimely exercise of withdrawal and late communication of the cardholder

- evidence of the good purchased compliant with the one actually received by the cardholder

Failed/Incomplete/Late Provision of a Service

The case in question materializes when cardholders declare that they:

✔ Have not received, in full or in part, the service purchased

✔ Have not received the service in the required times and have cancelled the purchase within the prescribed terms

✔ Have cancelled the purchase within the prescribed terms (e.g. cancellation of hotel booking, cancellation of travel tickets)

The Merchant, for its part, must demonstrate, in relation to the circumstances, that:

✔ The service has been provided in compliance with the methods and time scales formally stated at the time of the purchase

✔ The service was cancelled after the terms indicated

✔ The sums involved in the purchase have been refunded

The documentation to be provided is listed below:

Cardholder side

- Document proving the e-commerce purchase (e.g. payment confirmation screen with a description of the service purchased) through a BANCOMAT S.p.A. branded payment and the Merchant references.

- Reasons for the refund request (e.g. declaration of non-use of the service, of having cancelled the purchase within the signed terms through the cancellation of the hotel booking, vehicle return with no damage, cancellation of travel ticket).

- Correspondence with the Merchant regarding the dispute and Refund request.

Merchant side

- Proof of refund in the event the Cardholder’s complaint is accepted. Alternatively, proof of the correct action through:

- Document that proves the complete and timely provision of the service (e.g. log of phone top-up, hotel declaration that the customer has used the booking, booking cancellation) or untimely cancellation by the cardholder.

Provision of a Non-Compliant Service

The case in question materializes when the cardholder declares that the service purchased did not fully or partly comply with the description provided at the time of purchase.

The Merchant, for its part, must demonstrate, in relation to the circumstances, that:

✔ The Disputed service was provided according to methods compliant with the description provided at the time of the purchase

✔ The sums involved in the purchase have been refunded

The documentation to be provided is listed below:

Cardholder side

- Document proving the e-commerce purchase (e.g. payment confirmation screen with a description of the service purchased) through a BANCOMAT S.p.A. branded payment and the Merchant references.

- Correspondence/messages exchanged with the Merchant for the disputed receipt of a service that is different from the one purchased (e.g. e-mail, registered letter, screenshot of conversations in the Merchant environment) and request for reimbursement of sums.

- Where possible, proof of the service actually received (e.g. travel ticket provided, amount of the phone top-up received).

Merchant side

- Proof of refund in the event the Cardholder’s complaint is accepted. Alternatively, proof of the correct action based on one of the following assumptions:

- Evidence of the untimely exercise of withdrawal and late communication of the cardholder

- Evidence of the description of the service purchased by the cardholder, which complies with the one actually provided

Non-Repayment of Sums in the event of return

The case in question materializes when Cardholders declare that the Merchant:

✔ Has refused the cancellation of the transaction within the terms indicated in the purchase conditions

✔ Has not provided the address for the return of the goods purchased or is unreachable or has refused the return, requesting methods that are different from those published at the time of purchase

The Merchant, for its part, must demonstrate, in relation to the type of dispute, that:

✔ The customer has communicated the cancellation of the transaction after the term indicated in the purchase conditions

✔ The returns management methods conform to the conditions published on the site at the time of purchase

The documentation to be provided is listed below:

Cardholder side

- Document proving the e-commerce purchase (e.g. payment confirmation screen with description of the service purchased) through a BANCOMAT S.p.A. branded payment and the Merchant references.

- Correspondence/messages exchanged with the Merchant with the request for the reimbursement of the sums.

- Shipping note for the good in question to the address indicated in the purchase conditions.

Merchant side

- Proof of refund in the event the Cardholder’s complaint is accepted. Alternatively, proof of the correct action through:

- Evidence of the untimely exercise of the right of withdrawal and return of the good.

Flow

Updated over 1 year ago