SEPA

Integrate SEPA Direct Debit and allow merchants to collect Euro-denominated payments from accounts in the 34 SEPA countries and associated territories.

Payment Method Properties

| Available country codes | EU countries: AT, BE, BG, HR, CY, CZ, DK, EE, FI, FR, DE, GR, HU, IE, IT, LV, LT, LU, MT, NL, PL, PT, RO, SK, SI, ES, SE EEA Countries: IS, LI, NO Countries that have bilateral agreements with EU: AD, SM, MC, VA Other SEPA-supporting countries (supported EUR-denominated accounts only): PF, TF, GI, GG, IM, JE, BL, PM, CH, GB, WF, NC |

| Processing (Presentation) currencies | EUR |

| Settlement currencies | EUR |

| Consumer currencies | EUR |

| Channel member tag | sepaddmodela, sepaddmodelc |

| Scheme name in the settlement file | SEPA Direct Debit SEPA Direct Debit Model A SEPA Direct Debit Model C |

| Minimum transaction amount | EUR 0.10 |

| Maximum transaction amount | EUR 1,000 |

| Session timeout | 1 hour |

| Refund | Full, partial and multiple partial are all available. |

| Refund Validity | 365 days |

| Chargeback | Yes |

| Integration Type | Synchronous |

| Sandbox | PPRO-hosted |

The maximum transaction amount is configurable per merchant account to higher amounts, but chargeback risk increases.

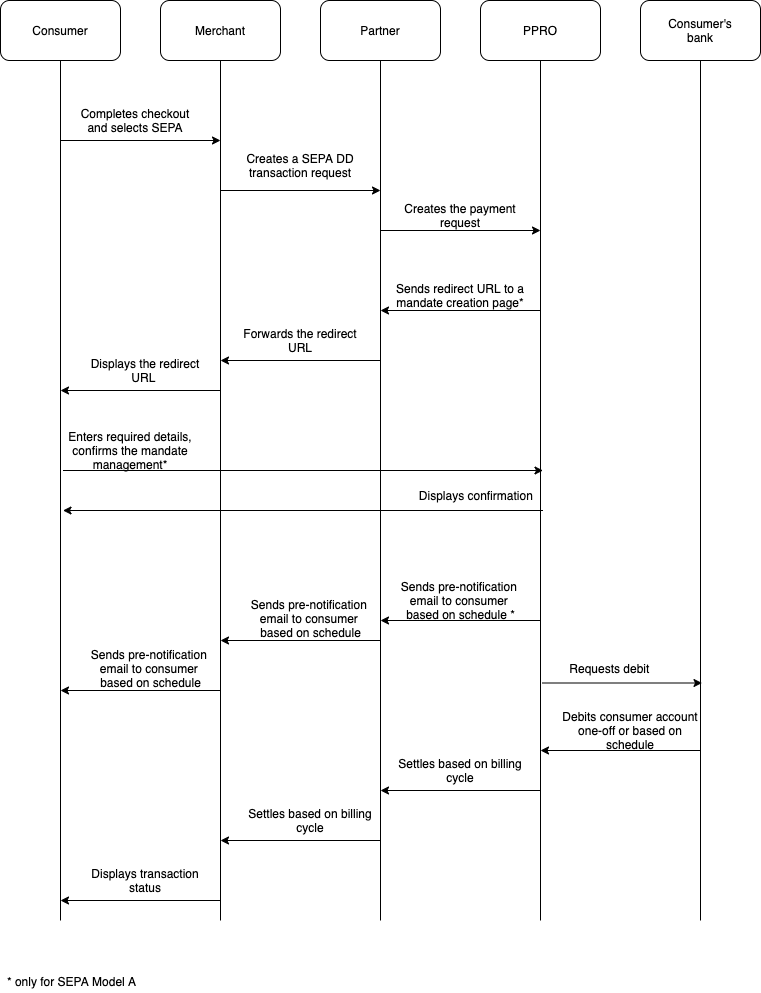

SEPA Direct Debit is available on two different models, depending on how you want to collect the mandates and generate the notifications:

- Model A - if you want PPRO to collect and store the mandates and to generate the pre-notification emails. Additionally, PPRO gives the consumer the option to consent or reject the mandate on a mandate page.

- Model C - if you want to collect the mandates and generate the pre-notification emails yourself.

Transaction Flow

- The consumer chooses SEPA as their payment method.

- The consumer is redirected to a payment page where they enter their IBAN/BIC and consent to a SEPA Mandate.

- The consumer is notified of the intermediate success of data retrieval.

- The merchant receives the confirmation of the payment after the batch is executed successfully.

- The merchant can ship the order to the consumer.

SEPA Direct Debit Chargeback

Consumers can issue a chargeback on a completed SEPA direct debit transaction via their bank. Reasons for issuing a chargeback include:

- The consumer did not receive the product

- The consumer is unsatisfied with the product

- Fraud (the payment was not authorized)

- Insufficient funds

- Nonexistent IBAN

SEPA Direct Debit has no real-time authorization that checks the balance available on the accounts. The transaction will be in a successful state even if a consumer does not have sufficient funds in their bank account to complete it. This behavior will lead to a chargeback.

It is not possible to check if the bank account exists before charging it. Fraudsters can generate fake IBANs using an online IBAN generator.

Thresholds

Chargeback ratios vary by industry and among individual merchants in a given industry.

Chargeback ratios, as seen by PPRO, are higher for SEPA Direct Debit than credit cards by SEPA's own design. As measured by transaction volume, an individual merchant's chargeback ratio exceeding 7.5% risks a response from PPRO to coordinate reducing the merchant's chargeback ratio and/or suspension of the merchant should chargeback mitigation be unsuccessful or at a volume that is considered an unacceptable risk by PPRO's banking partners.

Dispute process

It’s not possible to collect chargeback funds via SEPA Direct Debit. The merchant needs to collect the funds directly from the consumer, for example, via a collection agency.

Merchants using SEPA Direct Debit usually:

Ensure they have a good risk system in place, with velocity checks to mitigate the risk

Perform rigorous checks on the consumer before they allow SEPA Direct Debit payments, for example, completing credit checks, such as Schufa in Germany

Only allow a payment-guaranteed payment method, such as Giropay, for the first transaction with a particular customer

Employ a collection agency in case of chargebacks

Note

A refund does not protect you from a chargeback.

Time frame

The standard chargeback window for SEPA Direct Debit is eight weeks. After that time, the likelihood of chargebacks decreases if the merchant handles a mandate confirming the consumer's agreement for being charged.

It is still possible to get a chargeback after eight weeks in case the bank fights the mandate. The percentage of chargebacks issued after that time frame is below 0.1%. This extended chargeback period is 13 months.

Updated over 1 year ago