Bancomat Pay

BANCOMAT Pay is an Italian service that allows consumers to transfer money and buy goods and services. Transactions are online. Consumers can also use BANCOMAT Pay to pay invoices, taxes and so on.

Payment Method Properties

| Available country codes | IT |

| Processing (Presentation) currencies | EUR |

| Settlement currencies | EUR |

| Consumer currencies | EUR |

| Channel member tag | bancomatpay |

| Scheme name in the settlement file | BancomatPay |

| Minimum transaction amount | EUR 0.01 |

| Maximum transaction amount | No limit. Based on the consumer's bank account balance or the individual bank's rules on the transaction limit. |

| Session timeout | 1 hour (120 seconds default) |

| Refund | Full, multiple and partial refunds are all available. |

| Refund Validity | 12 months |

| Chargeback | Yes |

| Integration Type | Asynchronous |

| Sandbox | PPRO-hosted |

**The user must register their mobile number with Bancomat Pay beforehand. Once done, they can proceed with payment as shown below.

Shopper journey

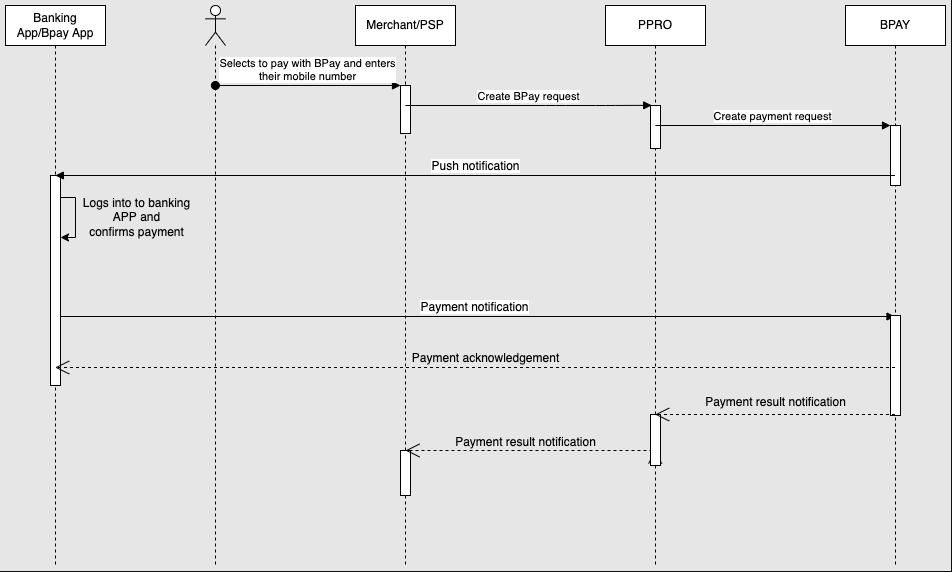

Direct Flow

- Consumer selects BANCOMAT Pay on the merchant's checkout page.

- If they are a first time user, the consumer enters their mobile number to proceed. If they have shopped before, the shopper selects their mobile number that appears on the screen.

- The consumer selects BANCOMAT Pay and a transaction request to PPRO occurs. PPRO sends the transaction to the Bancomat platform.

- BANCOMAT Pay then sends a push notification to the consumer's mobile device, and their banking app is automatically launched once the notification is clicked.

- The consumer logs into their banking app.

- The details of the transaction appear on the banking app and consumer confirms the payment.

- The banking app sends a payment notification to BANCOMAT Pay.

- BANCOMAT Pay send an acknowledgement back to the banking app.

- BANCOMAT Pay also send an acknowledgement to PPRO.

- PPRO sends a transaction result notification to the merchant or PSP. The consumer goes back to the merchant checkout and sees a confirmation message and can continue shopping.

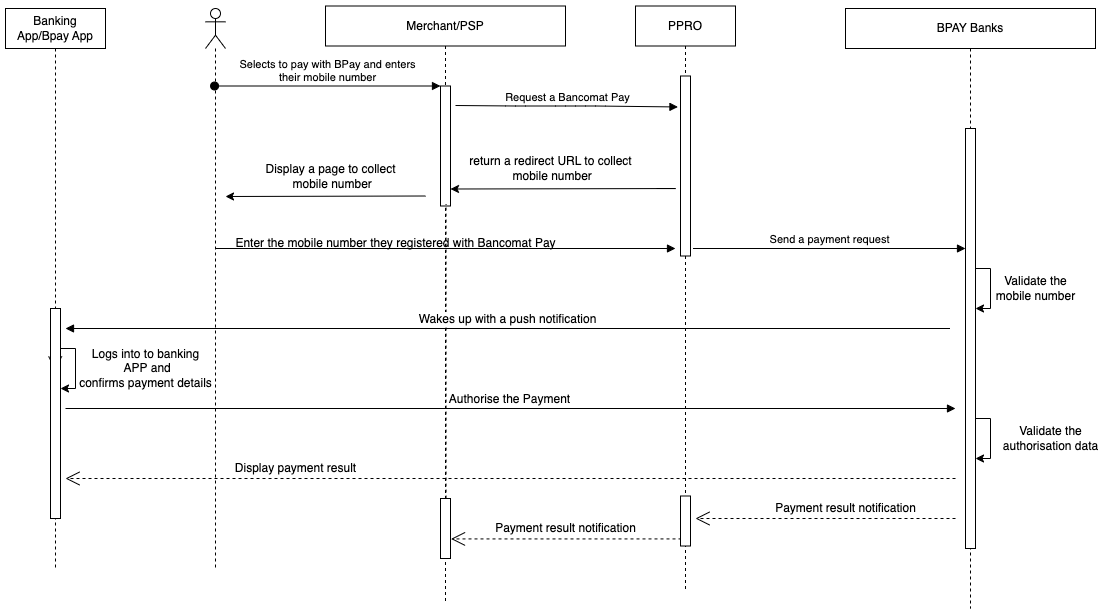

Redirect Flow

- When checking out on the Merchant’s website, the consumer selects the Bancomat pay.

- Merchant sends the payment request to PPRO.

- PPRO redirects the consumer to a page to enter the mobile number that they used to register with Bancomat pay.

- Bancomat pay calls up the Issuer Bank system to check on the validity of the mobile number. If it’s valid the issuer bank so sends a push notification to the consumer’s mobile banking App.

- The consumer clicks the notification to activate the App to confirm the payment detail.

- The consumer authorises the payment.

- The issuer bank checks the amount in the bank account and approve or decline the request.

- The payment result is displayed in the App to the consumer and the result notification is sent to PPRO and merchant.

Bancomat Pay Integration

Specific Input Parameters for the TRANSACTION call

| Field Name | M/O/C | Type | Description |

|---|---|---|---|

specin.phone | C | ascii | The mobile number of consumers that is registered with BANCOMAT Pay. Only EU mobile numbers are supported. The format should be +XXX with maximum of 20 characters. Mandatory to submit for the direct flow. |

For For standard input parameters, check Input parameters for the TRANSACTION call.

Specific Output Parameters for the TRANSACTION call

There are no specific output parameters for the TRANSACTION call. For standard output parameters check Output parameters for the TRANSACTION call.

TRANSACTION call input

tag=bancomatpay

&txtype=TRANSACTION

&countrycode=IT

¤cy=EUR

&amount=100

&merchanttxid=hT4kwQMsSdnA

&login=johndoe

&password=wXBrpVporjGO4R

&contractid=JOHNDOECONTRACT

&channel=testchannel

&merchantredirecturl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fhappylanding.php

¬ificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php

&specin.dynamicdescriptor=DynDescriptor

&accountholdername=John%20Doe

&specin.phone=+491735793030

&returnmode=urlencodeext

TRANSACTION call output

REQUESTSTATUS=SUCCEEDED

&STATUS=SUCCEEDED

&TXID=893812411

&ERRMSG=

&CHANNEL=testchannel

&TAG=bancomatpay&PAYMENTGUARANTEE=NONE

&REDIRECTSECRET=Zwoxs5b2Va23HvKCtViU1dLR2HSyWClA

Updated 2 months ago