Korean local cards

Integrate Korean local cards (including credit and debit cards) to allow consumers to make payments using one of 23 supported South Korean banks. Consumers can choose to pay for e-commerce purchases with their choice of local card connected to their bank account or credit card using a familiar QR code.

Supported banks include the following, see Appendix for full list of banks:

- Kookmin Bank

- Shinhan Bank

- Hana Bank

- Woori Bank

- Nonghyup Card

- Kakao Bank

- Tossbank

Payment Method Properties

| Available country codes | KR |

| Processing (Presentation) currencies | KRW |

| Settlement currencies | USD |

| Consumer currencies | KRW |

| Channel member tag | koreancard |

| Scheme name in the settlement file | Koreancard |

| Minimum transaction amount | KRW 100 |

| Maximum transaction amount | Customer credit limit |

| Session timeout | 20 minutes |

| Refund | Full, partial and multiple partial refunds are all available. |

| Refund Validity | 365 days |

| Chargeback | Yes |

| Integration Type | Asynchronous |

| Sandbox | Scheme-hosted |

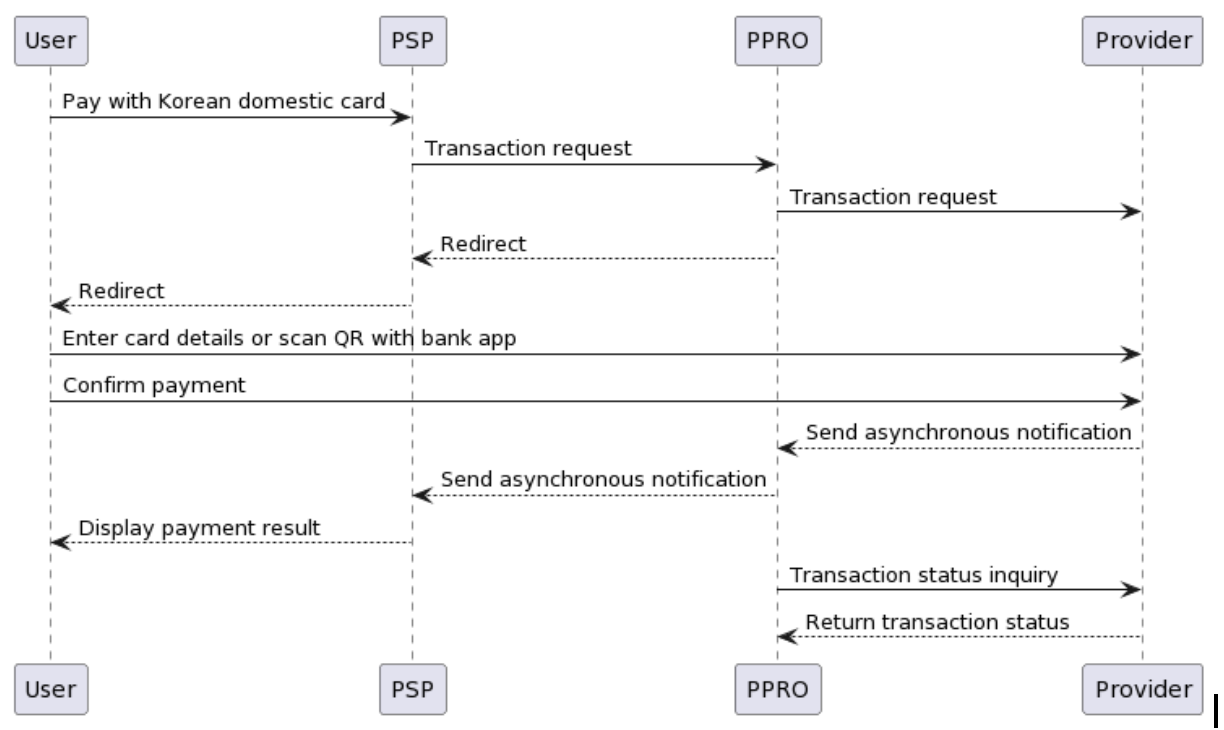

Transaction Flow

- On the merchant checkout page, the consumer selects paying with Korean domestic card.

- The PSP sends a Transaction request, which triggers a request to the provider.

- If the consumer is paying from a desktop browser:

- The consumer will be asked to enter their credit card information.

- A push notification will be sent to their mobile device to complete the authentication process in their mobile banking app. If the consumer does not have the app installed, an SMS will be sent with an OTP to complete the authentication process.

- Alternatively, the customer can scan the on-screen QR code with their bank app to complete the payment process.

- If the consumer is paying from a mobile device:

- The consumer will be asked to enter their credit card information.

- A push notification will be sent to their mobile device to complete the authentication process in their mobile banking app. If the consumer does not have the app installed, an SMS will be sent with an OTP to complete the authentication process

- Alternatively, the consumer can click on their bank logo on screen, and be deeplinked to their bank app if they have it installed on their mobile device to complete the payment process.

Korean local cards Integration

Specific input parameters for the TRANSACTION call

| Field Name | M/O/C | Regex | Description |

|---|---|---|---|

specin.email | O | [\w-\.]+@([\w-]+\.)+ | The consumer's email address |

specin.cardissuer | O | [\w\s]+ | Used to skip the issuer selection page, when the card issuer is known. Valid values in English and Korean are listed in the Appendix. |

For standard input parameters, see Input parameters for the TRANSACTION call.

This payment method supports the dynamic descriptor field (see The dynamic descriptor).

Specific output parameters for the TRANSACTION call

| Field Name | Type | Description |

|---|---|---|

SPECOUT.CARDMASKEDPAN | ascii | Masked card number of the card used by the customer |

SPECOUT.APPROVALCODE | ascii | Approval code of the card payment if payment succeeded |

For standard output parameters, see Output parameters for the TRANSACTION call.

TRANSACTION call input

tag=koreancard

&txtype=TRANSACTION

&countrycode=KR

¤cy=KRW

&amount=15000

&merchanttxid=mCYaU22CeZWh

&login=johndoe

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOECONTRACT

&channel=testchannel&merchantredirecturl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php¬ificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php&specin.dynamicdescriptor=%ED%86%A0%EC%8A%A4+%ED%8B%B0%EC%85%94%EC%B8%A0+%EC%99%B8+2%EA%B0%9C+%EC%95%84%EC%9D%B4%ED%85%9C&[email protected] &specin.cardissuer=VISA&accountholdername=John%20Doe&returnmode=urlencodeext

TRANSACTION call output

REQUESTSTATUS=SUCCEEDED

&STATUS=SUCCEEDED

&FUNDSTATUS=WAITING

&TXID=1266924844

&MERCHANTID=mCYaU22CeZWh

&ERRMSG=

&CHANNEL=testchannel

&TAG=koreancard

&REDIRECTSECRET=OTzp0pFUOGPMsW3KQSPhzrgHEa4h1DNw

&REDIRECTURL=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php

&SPECOUT.APPROVALCODE=00000000

&SPECOUT.CARDMASKEDPAN=41231234****123*

&amount=10000

Specific input parameters for the REFUND call

| Field Name | M/O | Description |

|---|---|---|

specin.refundreason | M | Used to indicate why a refund is needed |

Specific output parameters for the REFUND call

| Field Name | Type | Description |

|---|---|---|

SPECOUT.REFUNDEDAT | ascii | Refund accepted timestamp from Toss |

Appendix

List of accepted card issuer names for specin.cardissuer. Note that you can either values from the 'Korean' and 'English' column.

| Korean Value | English Value | Description |

|---|---|---|

| 광주 | GWANGJUBANK | Kwangju Bank |

| 국민 | KOOKMIN | KB Kookmin Card |

| 농협 | NONGHYEOP | NH Nonghyup Card |

| 롯데 | LOTTE | Lotte Card |

| 산업 | KDBBANK | KDB Industrial Bank |

| 삼성 | SAMSUNG | Samsung Card |

| 새마을 | SAEMAUL | Saemaul Geumgo |

| 수협 | SUHYEOP | Sh Suhyup Bank |

| 신한 | SHINHAN | Shinhan Card |

| 신협 | SHINHYEOP | credit union |

| 씨티 | CITI | Citi Card |

| 우리 | WOORI | Woori card |

| 우체국 | POST | Postal Deposit Insurance |

| 저축 | SAVINGBANK | Korea Savings Bank Federation |

| 전북 | JEONBUKBANK | Jeonbuk Bank |

| 제주 | JEJUBANK | Jeju Bank |

| 카카오뱅크 | KAKAOBANK | Kakao Bank |

| 케이뱅크 | KBANK | K bank |

| 토스뱅크 | TOSSBANK | Toss Bank |

| 하나 | HANA | Hana Card |

| 현대 | HYUNDAI | Hyundai Card |

| - | BC | BC Card |

Additional Information

Integration options

There are two integration options:

- Using a Toss-hosted payment page

- By-passing the HPP and redirecting straight to one of the supported banks

Using a Toss-hosted payment page

If specin.cardissuer is not provided, the consumer is redirected to a Toss-hosted payment page, displaying all available banks.

The consumer is either prompted to select a bank on the Toss HPP or scan a QR code.

By-passing the HPP and redirecting straight to the supported bank

The second option requires you to send PPRO the specin.cardissuer of each supported bank.

The full list of supported banks can be viewed here, Appendix.

Updated over 1 year ago