Afterpay Dispute/Chargebacks

In the following topics you can find information related to how to handle disputes / chargebacks

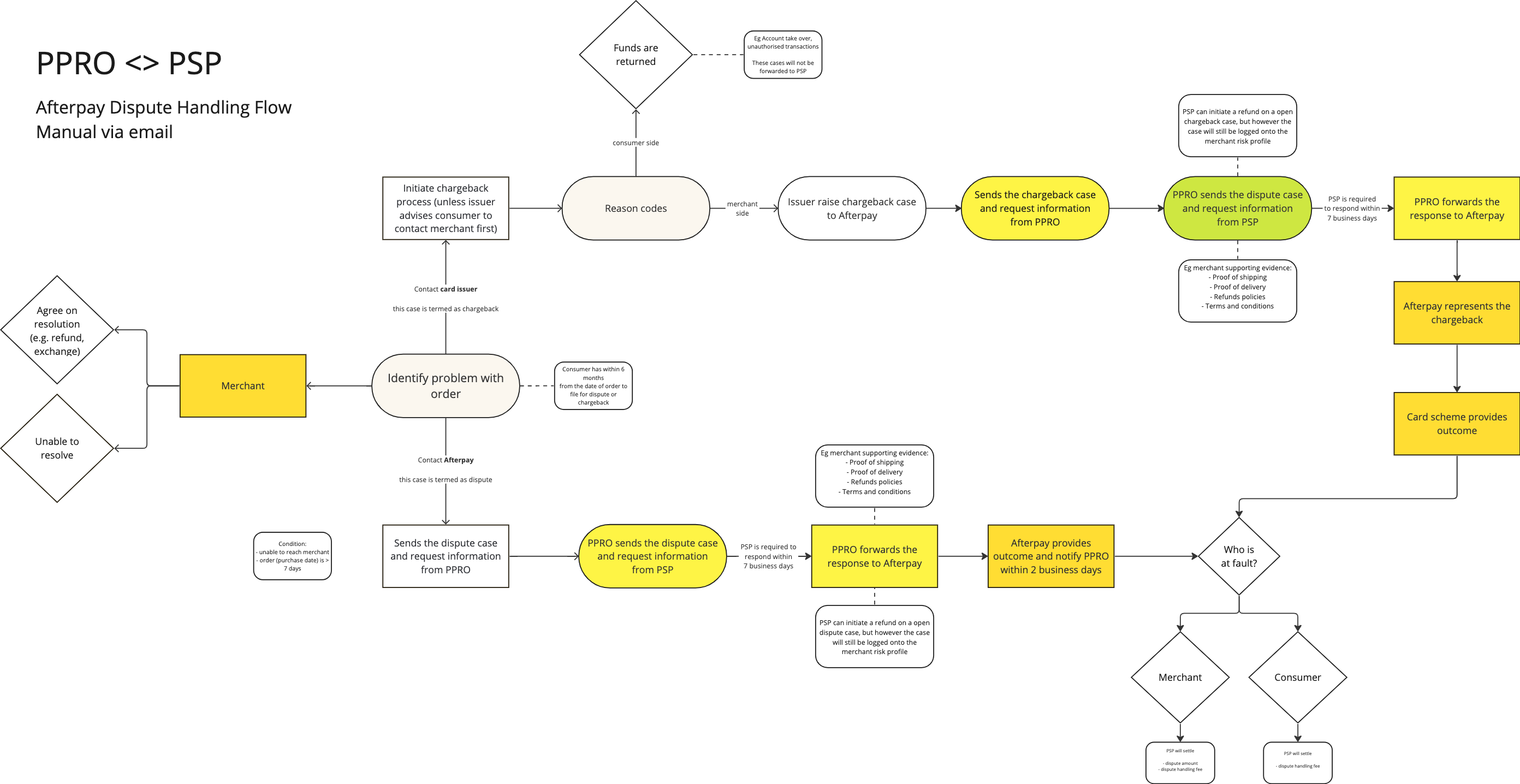

A consumer has up to 180 days from the order date to raise a dispute with Afterpay or chargeback with their card issuer when they are unable to resolve the situation directly with the merchant.

Notifications

PPRO will send you an email with any new disputes or chargebacks. The section below shows you the lifecycle diagram of disputes and chargebacks.

Disputes and chargebacks that cannot be resolved in the favour of the merchant are debited by a chargeback event in the Payment Gateway. You will receive a report of these chargeback events on a daily basis by SSH File Transfer Protocol (SFTP).

Fees

There is a chargeback handling fee for any dispute / chargeback raised regardless of the outcome. Once a dispute / chargeback is finalised, if the case is resolved in favour of the consumer, the chargeback amount is deducted from the balance at the same time.

Time frame

Once the PSP/merchant is notified, they are required to provide a response to PPRO within 7 business days.

Disputes / Chargebacks Process

Consumers will contact Afterpay or their card issuer with complaints about the merchant or a product that they have been sold. In all cases the consumer is referred directly to the merchant to resolve.

If the merchant is unresponsive or does not satisfy the consumer, the consumer may escalate the matter to Afterpay or their card issuer. The consumer must provide all information about their issue and give any supporting evidence. This includes all correspondence from the merchant.

Afterpay then contact PPRO; we then notify the Payment Service Provider (PSP) or merchant with full details of the consumer dispute/chargeback. The PSP/merchant must provide a response within 7 business days.

The merchant's response should include all relevant information they have used to assess the consumer’s complaint. In most instances this is proof of delivery. Or the merchant's response can be confirmation that all terms of the sale have been met. In addition there may be confirmation of any offers made to the consumer to resolve the issue.

When Afterpay or Card Issuers receive all the required information, their team reviews the relevant information and makes a decision. They inform all necessary parties of this decision.

Updated about 1 year ago