Multibanco

Integrate Multibanco and allow consumers to pay via online banking or pay in cash at a bank branch.

Payment Method Properties

| Available country codes | PT |

| Processing (Presentation) currencies | EUR |

| Settlement currencies | EUR |

| Consumer currencies | EUR |

| Channel member tag | multibanco |

| Scheme name in the settlement file | Multibanco |

| Minimum transaction amount | No limit |

| Maximum transaction amount | EUR 99,999 |

| Session timeout | 7 days |

| Refund | Full, partial and multiple partial refunds are all available. |

| Refund Validity | 15 months |

| Chargeback | Yes |

| Integration Type | Asynchronous |

| Sandbox | PPRO-hosted |

Transaction Flow

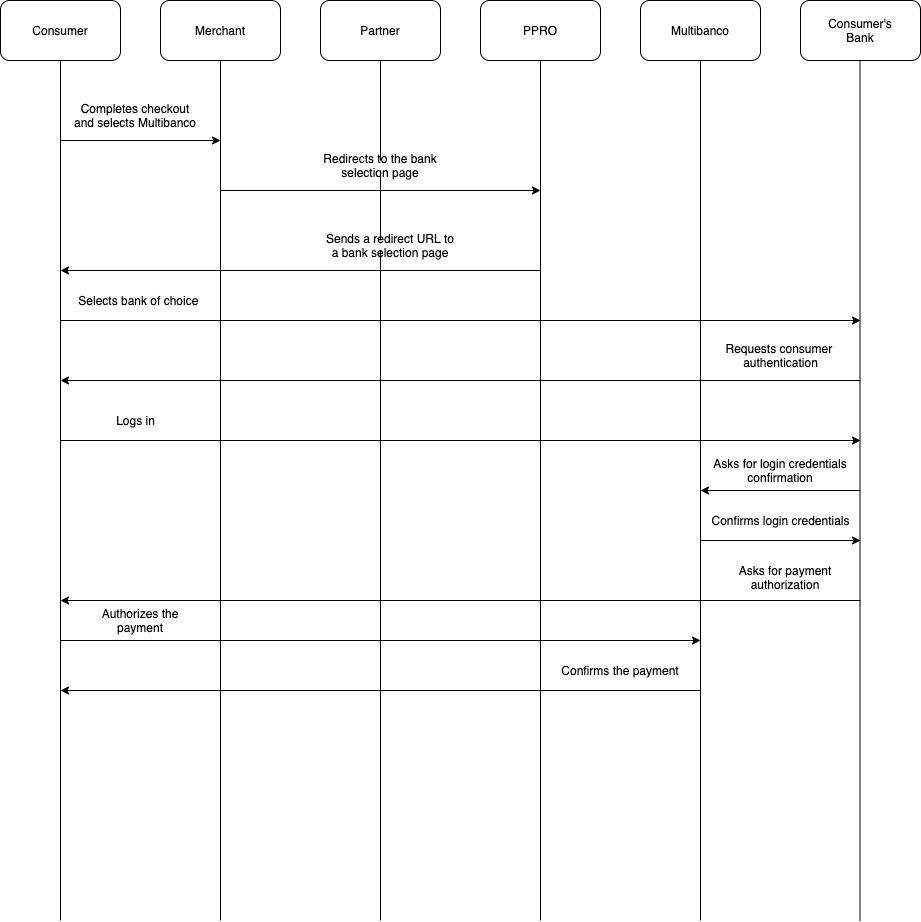

Online Banking

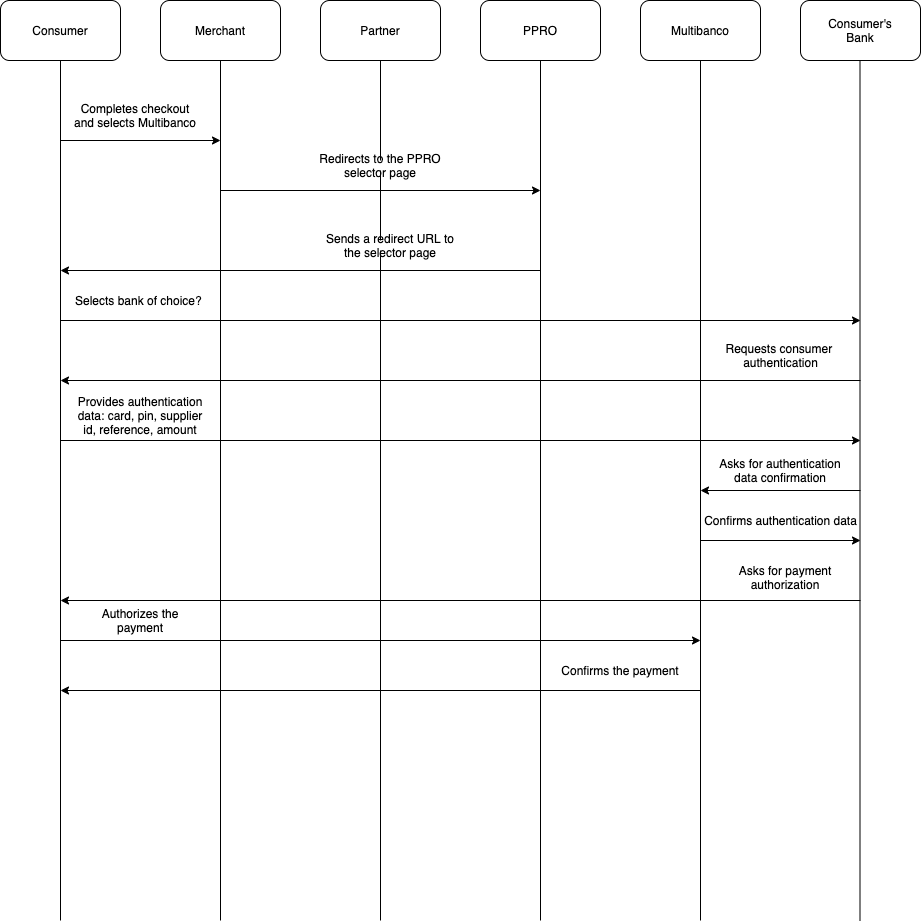

Pay at ATM

- The consumer selects Multibanco on the merchant checkout page.

- The merchant redirects the consumer to the PPRO bank selector page.

- PPRO loads the page with references and instructions.

- The consumer chooses one of the following options:

- Online Banking

- Pay at Multibanco ATM

- If the consumer selects the online banking options, they provide the login details.

- The consumer is redirected to the bank to provide the supplier id, reference, and amount to Multibanco.

- Multibanco confirms the details, and the consumer is asked to authorize the payment.

- If the consumer selects the Multibanco ATM option, they enter the Card/PIN details.

- The consumer provides the supplier ID, reference, and amount. The authorization is complete.

- The bank sends a confirmation to Multibanco.

- Multibanco sends a confirmation to PPRO PPRO sends a confirmation to the merchant.

- The merchant confirms the successful payment to the consumer.

Multibanco Integration

Specific input parameters for the TRANSACTION call

| Field Name | M/O | Description |

|---|---|---|

| specin.timeoutinminutes | Optional | Can be used to send in the request to modify the default payment timeout ( 7days). For example, if specin.timeoutinminutes = 10,_ means the transaction will expire in 10minutes if the user has not completed the payment. Accepted range is [1...10080]. |

For standard input parameters, see Input parameters for the TRANSACTION call.

Specific output parameters for the TRANSACTION call

| Field Name | Type | Description |

|---|---|---|

SPECOUT.MULTIBANCOPAYMENTREFERENCE | ascii | Contains the payment reference of the transaction. Can be used to build your own payment slip. |

SPECOUT.MULTIBANCOSERVICESUPPLIERID | ascii | Contains the entity reference of the transaction. Can be used to build your own payment slip. |

SPECOUT.PAYMENTPURPOSE | ascii | PPRO Payment Reference |

See Well-known SPECOUT parameters for details of the general specific output parameters.

For standard output parameters, see Output parameters for the TRANSACTION call.

TRANSACTION call input

tag=multibanco

&txtype=TRANSACTION

&countrycode=PT

¤cy=EUR

&amount=1055

&merchanttxid=JKJhPbQQyYq9

&login=johndoe

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOECONTRACT

&channel=channelname

&merchantredirecturl=https://merchant.com/work/ppro2/landing.php

¬ificationurl=https://merchant.com/work/ppro2/notification.php

&specin.dynamicdescriptor=DynDescriptor

&accountholdername=John Doe

&returnmode=urlencodeext

TRANSACTION call output

REQUESTSTATUS=SUCCEEDED

&STATUS=SUCCEEDED

&MERCHANTTXID=JKJhPbQQyYq9

&FUNDSSTATUS=NOT_EXPECTED

&RAND907728218=490ef344134200d991d13f992e65e3d0941c5435

&FLAGS=

&TXID=622261966

&ERRMSG=

&CHANNEL=testchannel

&TAG=multibanco

&REDIRECTSECRET=WAiUGCNGdBdzYI4OIr2jh611D37PsT3U

&SPECOUT.MULTIBANCOPAYMENTREFERENCE=999999964

&SPECOUT.MULTIBANCOSERVICESUPPLIERID=11854

&SPECOUT.PAYEMENTPURPOSE=1234ABC

FAQ

How do Multibanco refunds work?

There are no specific parameters needed to process a Multibanco refund. You can send a standard REFUND call for a successful existing Multibanco transaction to refund it.

Your REFUND response will contain the following SPECOUT parameters:

| Field Name | Type | Description |

|---|---|---|

SPECOUT.TRANSACTIONID | ascii | ID of the Multibanco refund. Should be visible to the consumer and thus can be used by the merchant to track the refund status. |

SPECOUT.TRANSACTIONRECIPIENTID | ascii | Multibanco ID of the consumer getting their funds back. |

Updated 4 months ago