PostFinance: E-Finance (Not Currently Available)

Integrate PostFinance (YellowPay E-Finance) and allow merchants to accept payments from the 8 million Swiss Post users.

Payment Method Properties

| Available country codes | CH |

| Processing (Presentation) currencies | EUR, CHF |

| Settlement currencies | EUR, CHF |

| Consumer currencies | EUR, CHF |

| Channel member tag | postfinance, yellowpay |

| Scheme name in the settlement file | Yellowpay |

| Minimum transaction amount | no limit |

| Maximum transaction amount | PostFinance Card: CHF 500 or EUR 350 per month E-finance: no limit |

| Session timeout | 30 minutes |

| Refund | Full, partial and multiple partial refunds are all available. |

| Refund Validity | 365 days |

| Chargeback | No |

| Integration Type | Synchronous |

| Sandbox | PPRO-hosted |

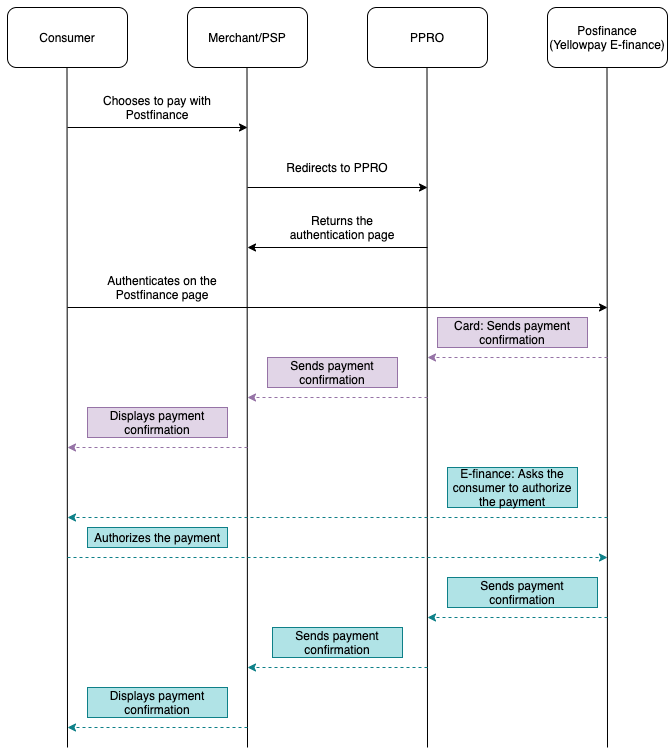

Transaction Flow

- The consumer selects PostFinance on the merchant's checkout page.

- They are redirected to a page where they must select one of the following options:

- PostFinance Card or E-Finance for amounts lower than 500 CHF

- PostFinance E-Finance for amounts higher than 500 CHF

- The merchant redirects the consumer to the PPRO redirector page with the payment reference and the instructions.

- The consumer goes to the PostFinance authentication page to see the order number, amount, and timestamp.

- For PostFinance Card:

- The consumer selects to pay via the PostFinance App (by scanning a QR code on the app on their mobile device) or the PostFinance card (by entering their ID number and confirming the payment).

- They are redirected to the merchant's website.

- For PostFinance E-Finance:

- The consumer is asked to authorize the payment by entering their E-Finance number and confirming the payment. Alternatively, they can use their username and password.

- Once the payment is authorized, the consumer is redirected to the merchant's website.

- PPRO receives a payment confirmation and notifies you/the merchant about the payment status.

- The merchant is notified of the payment status and can ship the goods.

PostFinance Integration

Specific input parameters for the TRANSACTION call

| Field Name | M/O/C | Type | Description |

|---|---|---|---|

specin.mobileview | O | ascii | Set to yes for the mobile-enabled version of PostFinance |

For standard input parameters, see Input parameters for the TRANSACTION call.

Specific output parameters for the TRANSACTION call

| Field Name | Type | Description |

|---|---|---|

SPECOUT.YELLOWPAYTXID | ascii | PostFinance's transaction ID |

For standard output parameters, see Output parameters for the TRANSACTION call.

TRANSACTION call input

tag=yellowpay

&txtype=TRANSACTION

&countrycode=CH

¤cy=CHF

&amount=1055

&merchanttxid=8YcYAfyJ9QXM

&login=johndoe

&password=wXBrpVporFVjGO4R

&contractid=JOHNDOECONTRACT

&channel=testchannel

&merchantredirecturl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Flanding.php

¬ificationurl=https%3A%2F%2Fmerchant.com%2Fwork%2Fppro2%2Fnotification.php

&specin.dynamicdescriptor=DynDescriptor

&accountholdername=John%20Doe

&specin.mobileview=no

&returnmode=urlencodeext

TRANSACTION call output

REQUESTSTATUS=SUCCEEDED

&STATUS=SUCCEEDED

&TXID=815333680

&ERRMSG=

&CHANNEL=testchannel

&TAG=yellowpay

&PAYMENTGUARANTEE=NONE

&REDIRECTSECRET=J4xnadD5kZ1vhfrV6Kwizudt10jr3WAk

Branding Guidelines

For branding information, see the PostFinance (YellowPay E-finance) branding guidelines.

Additional Information

- Transactions may change from any state, especially from FAILED to a SUCCEEDED state at any time. SUCCEEDED itself is considered a stable state (see also Important note about transaction states).

- To collect consumer funds, the merchants need to create an account with PostFinance. PostFinance can then activate merchants for the supported payment products: PostFinance Card, PostFinance E-Finance, or both (depending on the chosen options).

Updated 15 days ago