Fund status

Once a payment charge is captured, the scheme or provider settles the funds to PPRO, with settlement times varying by payment method. Any successful refunds are deducted from the settled amount.

PPRO sends a webhook notification whenever the fund status of a payment charge or refund changes. You can also retrieve the current status at any time using the Get fund status endpoint.

Statuses

| Fund status | Description |

|---|---|

CAPTURE_FUNDS_NOT_EXPECTED | PPRO does not expect to receive funds for this payment charge. This applies to processing-only payment methods. |

CAPTURE_FUNDS_WAITING | The initial fund status while PPRO awaits settlement of funds. |

CAPTURE_FUNDS_RECEIVED | PPRO has received the funds. |

CAPTURE_FUNDS_MISSING | PPRO has not received the funds within the expected timeframe. |

REFUND_FUNDS_NOT_EXPECTED | PPRO does not expect to send funds for this refund. This applies to processing-only payment methods. |

REFUND_FUNDS_WAITING | The initial fund status while PPRO awaits settlement confirmation for the refund. |

REFUND_FUNDS_SENT | PPRO has been notified, via settlement, that the refund funds have been received and sent to the consumer. |

REFUND_FUNDS_REJECTED | PPRO has not been notified, via settlement, of the refund confirmation within the expected timeframe. |

Non-native refundsFor payment methods that do not support native refunds, PPRO issues the refund directly from its own bank account.

In this scenario,REFUND_FUNDS_SENTindicates the point at which PPRO initiates the refund from its account.

REFUND_FUNDS_REJECTEDindicates that the refund amount has been returned to PPRO because the transfer was rejected by the recipient’s bank.

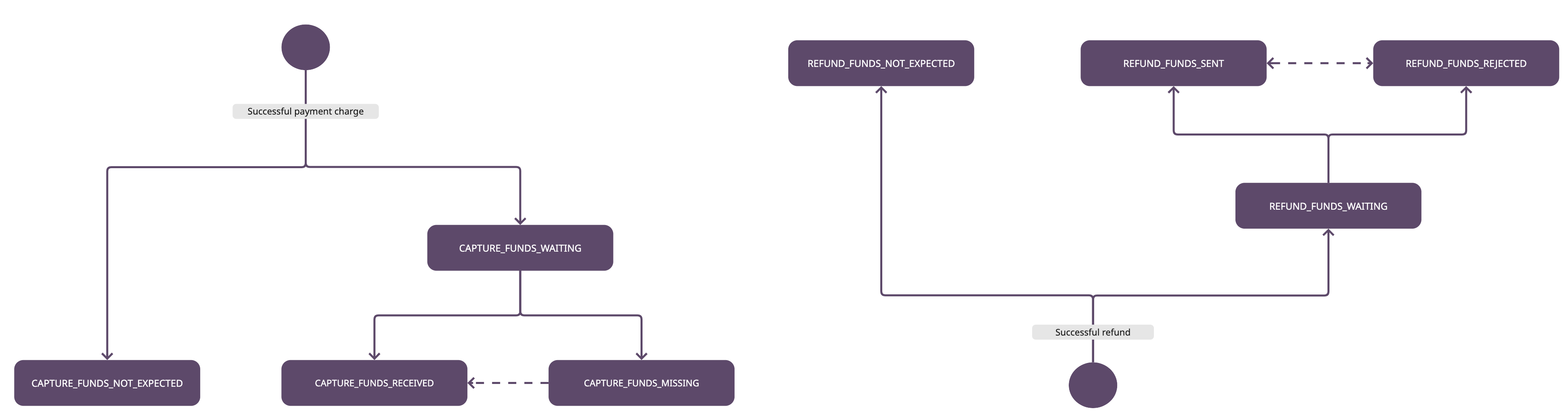

State machine

Retrieve fund status

The funds status of a payment charge and any associated refunds can be obtained by calling the fund statuses endpoint.

Request

GET /v1/payment-charges/{paymentChargeId}/funds-statuses

Response

You'll receive both the payment charge and any successful refunds.

[

{

"operationId": "capture_k76s1uANLrwDsR3YwLVGE",

"operationType": "CAPTURE",

"fundsStatus": "CAPTURE_FUNDS_RECEIVED",

"merchantPaymentChargeReference": "a2c8f7b1-54de-4d5a-bec7-91fbbd62e3f2"

},

{

"operationId": "refund_wNB1f784W9Qewe0PbZF3g",

"operationType": "REFUND",

"fundsStatus": "REFUND_FUNDS_SENT",

"merchantRefundReference": "fd563b6d-bffe-472e-b206-8d3eefbcdd6f"

}

]Settlement risk

Some payment methods carry a risk of non-settlement. This occurs when a payment charge is CAPTURED but the funds fail to settle to PPRO, resulting in a CAPTURE_FUNDS_MISSING status and a loss to the merchant. Although this happens only in a very small percentage of cases, merchants - depending on their risk appetite - may choose to ship goods or provide services only when the fund status is CAPTURE_FUNDS_RECEIVED to eliminate the possibility of missing funds.

Provider confirmation pending

Providers (such as Trustly) can mitigate settlement risk by using the AUTHORIZATION_ASYNC status. In this flow, the payment charge only transitions to CAPTURED after the provider has confirmed receipt of funds.

Updated 5 months ago